CNC Finance: Options and Tips for Financing Your Machining Needs

The world of CNC machining is one of precision, innovation, and undeniably huge investment. Whether you’re a nascent startup, an established manufacturing company, or an individual tinkerer pushing the boundaries of engineering, obtaining the necessary capital to purchase or upgrade CNC equipment and tools can be a critical hurdle. Understanding your financial options and implementing smart strategies is crucial to achieving your processing goals without breaking the bank.

This article explores the landscape of CNC finance, takes an in-depth look at the various financing avenues available, and provides practical tips for navigating the complexities of financing machining projects.

Understand your financing needs

Before delving into financing options, it’s crucial to accurately assess your specific needs. It’s not just about understanding the cost of a new CNC machine. Consider the following points:

-

Equipment cost: Research different CNC machine brands and models, comparing specs and features to find the product that best suits your operation’s requirements – for example, GreatLight’s team specializes in five-axis CNC machining. Get a detailed quote including base price, optional features, installation and training.

-

Tooling and Fixtures: Cutting tools, fixtures, fixtures and workholding solutions are essential for CNC machining. Estimate these costs, keeping in mind the type of materials you will be using and the complexity of the design. Do you need specialized tools for a specific material? Take this into consideration.

-

Software and training: Don’t underestimate the cost of CAD/CAM software licensing and operator training. Even the most advanced machines are useless without skilled operators and efficient programming. Some vendors offer bundled software and training packages.

-

Maintenance and repair: CNC machine tools require regular maintenance and occasional repairs. Consider the cost of maintenance contracts, spare parts and potential downtime. Consider machines from providers with strong support and service agreements.

-

Operating costs: Electricity, compressed air (if required), coolants and lubricants are ongoing operating expenses that should be included in your financial projections.

- Facility upgrades: Do you need to upgrade your facility to accommodate new equipment? This may include electrical modifications, ventilation improvements or temperature control systems.

A well-prepared budget not only helps you determine the amount of financing you need, but also strengthens your financing application by demonstrating your preparedness and understanding of investing.

Explore financing options

Once you have a clear understanding of your financing needs, it’s time to explore your financing options. Here’s a breakdown of the most common pathways:

-

Traditional bank loan: Banks offer a variety of loan products, including term loans, lines of credit and equipment financing. A term loan offers a fixed amount of capital and a fixed repayment schedule, while a line of credit offers greater flexibility, allowing you to borrow funds as needed. Equipment financing is specifically for the purchase of equipment and is typically secured by the equipment itself. Banks typically require a good credit score, a solid business plan, and collateral.

-

Small Business Administration (SBA) Loans: The SBA does not make loans directly, but instead guarantees loans made by participating lenders, reducing risk for lenders and making it easier for small businesses to obtain financing. SBA loans typically have more favorable terms than traditional bank loans, such as longer repayment terms and lower interest rates. You need to meet specific eligibility requirements to qualify for an SBA loan.

-

Equipment rental: Leasing allows you to use CNC equipment without owning it. You make periodic lease payments over a specified period, and at the end of the lease you have the option to purchase the equipment, renew the lease, or return the equipment. Leasing offers several advantages, including lower upfront costs, tax benefits (lease payments are tax-deductible), and the ability to upgrade to newer equipment at the end of the lease term.

-

Equipment Financing: There are several lenders that specialize in equipment financing. These lenders typically have an in-depth understanding of the CNC machining industry and can provide customized financing solutions to meet your specific needs. They may also have more flexible lending standards than traditional banks.

-

Online Lenders: Online lenders offer a streamlined application process and faster approval times than traditional banks. However, they usually charge higher interest rates and fees. Carefully compare the terms and conditions of online loans before making a commitment.

-

Venture Capital and Angel Investors: If you are a startup with disruptive technology or an innovative business model, you may be able to attract venture capital or angel investors. These investors provide capital in exchange for equity in your company. This option is generally more suitable for businesses with high growth potential.

-

Grants and Government Programs: Research government grants and programs that support manufacturing and technology innovation. These programs can provide non-repayable funding for specific projects or equipment purchases.

-

Personal Savings and Investments: If you have enough personal savings or investments, you can use them to meet your CNC machining needs. This eliminates the need to borrow money and pay interest. However, it is important to consider the opportunity cost of using personal funds.

- Seller Financing: Sometimes, the seller of CNC equipment may be willing to provide financing. This may be a good option if you have difficulty obtaining financing from traditional lenders.

Tips for Securing CNC Financing

Securing CNC financing requires careful planning and preparation. Here are some tips to increase your chances of success:

-

Create a strong business plan: A well-written business plan is crucial to attracting lenders and investors. Your business plan should include a detailed description of your business, target markets, competitive advantages, financial projections, and management team.

-

Improve your credit score: A good credit score is crucial to obtaining financing at favorable terms. Check your credit report regularly and take steps to improve your score, such as paying bills on time and reducing debt.

-

Provide collateral: Collateral can help secure your loan and reduce the lender’s risk. This can include assets such as real estate, equipment or inventory.

-

Shop around for the best prices and terms: Don’t settle for the first financing offer you receive. Compare rates, terms, and fees from multiple lenders to find the best deal.

-

Negotiation terms: Don’t be afraid to negotiate the terms of your financing agreement. This may include negotiating interest rates, repayment plans or fees.

-

Get expert advice: Consult a financial advisor or accountant for professional guidance on your CNC machining financing needs.

- Choose the right equipment: Work with a manufacturer like GreatLight who can not only provide the machine, but also provide expert guidance on which machine is best for your long-term needs. Choosing versatile and reliable equipment can maximize your return on investment by reducing the need for frequent upgrades or expensive repairs.

in conclusion

Financing a CNC machining project can be complex, but with careful planning, research, and preparation, you can obtain the necessary funds to achieve your goals. By understanding your financing needs, exploring your options, and following the tips outlined in this article, you can make informed decisions and build a successful CNC machining business. Remember to work with a reputable equipment provider like GreatLight, who offer expertise and support throughout the entire process. With the right financial strategy and the right equipment, you can unlock new possibilities and increase your processing capabilities.

Frequently Asked Questions (FAQ)

Q: What credit score do I need to get a CNC machine loan?

A: The required credit score varies by lender, but generally speaking, you need a good to excellent credit score (usually 680 or higher) to qualify for a CNC machine loan at a competitive interest rate. Credit requirements for SBA loans may be slightly more relaxed.

Q: Is it better to lease or buy CNC machine tools?

A: The best option depends on your specific situation. Leasing can offer lower upfront costs and tax benefits, while purchasing allows you to build equity and take full ownership of the equipment. When making your decision, consider your budget, cash flow, tax situation and long-term plans.

Q: What are the typical interest rates for CNC machine loan loans?

A: Interest rates vary based on factors such as your credit score, loan term, lender type, and the overall economic environment. Shop around and compare rates from multiple lenders to find the best deal.

Q: How much down payment is required for a CNC machine tool loan?

A: Down payment requirements vary by lender and loan type. Equipment financing may require 10-20% down, while an SBA loan may require a lower down payment.

Q: Can I get financing on a used CNC machine?

A: Yes, many lenders offer financing for used CNC machine tools. However, the terms and conditions may differ from those for new equipment. Always have a used machine inspected by a qualified technician before purchasing.

Q: What are the tax benefits of owning CNC equipment?

A: Owning CNC equipment may qualify you for tax deductions such as depreciation and Section 179 expenses. Consult a tax advisor to determine the specific tax benefits available to you.

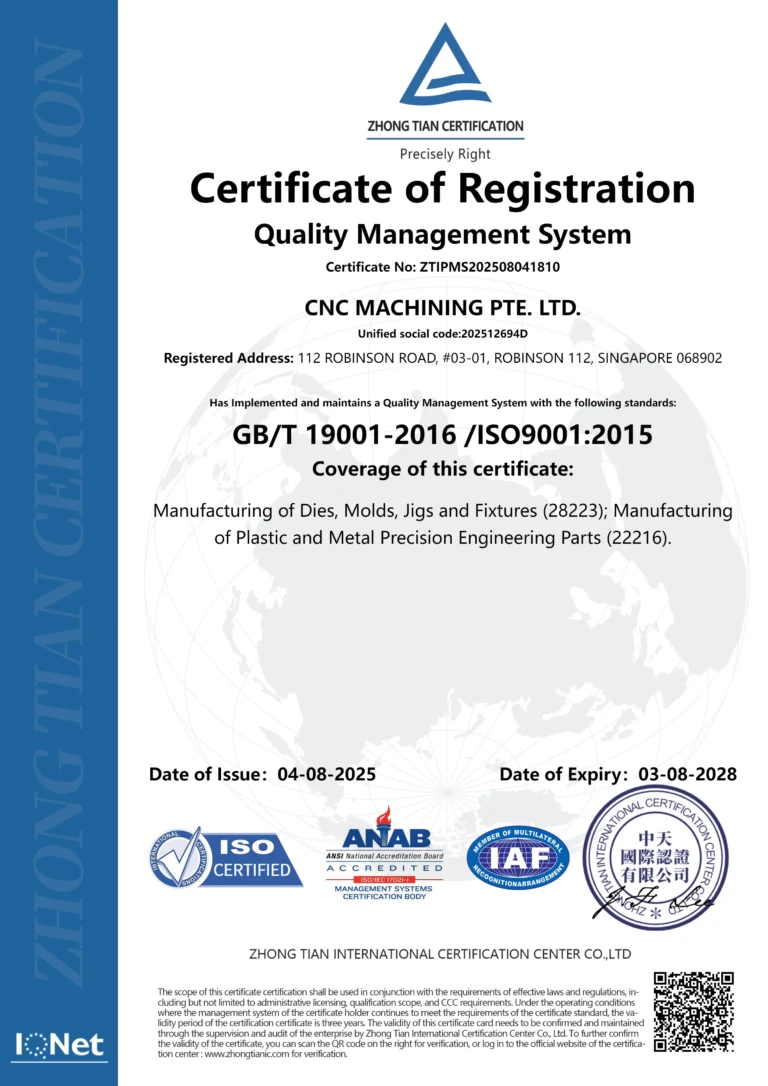

Q: How does GreatLight help with financing?

A: While GreatLight is a manufacturer and provider of CNC machining solutions, our expertise in the industry allows us to guide customers in understanding the total cost of ownership and selecting equipment consistent with their financial capabilities. We can also connect you with a network of financing partners who specialize in financing equipment for the CNC industry. Our focus is on delivering tailor-made machining solutions and supporting customers in achieving their long-term manufacturing goals.