2023Year6moon26day,Mohou.com learned thatwith a focus on personalization3DOrthopedic material printingRestoration3Dannounced that it would acquireCompliantjointly lead the development of this field.Restoration3DFor its use in orthopedic and spinal surgery3DPrinting technology is known to improve patient outcomes and surgical efficiency.

According to the transaction,Restoration3Dper share2.27Purchase price in US dollarsCompliantof all shares, relative to the share price before the transaction (1.16USD), the premium reached approx.96%。Restoration3DCurrently owner7500,000 shares outstanding, the amount of this acquisition should be1700million US dollars (1.22billion), although the exact figure has not yet been officially confirmed.

△Restore3dOptimized porousTideArchitecture, designed for bone implants

brief reviewCompliantdevelopment history

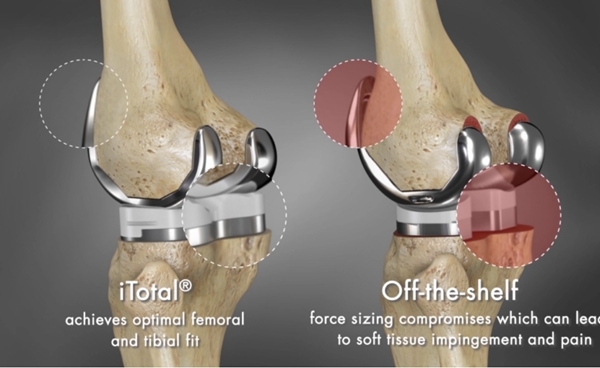

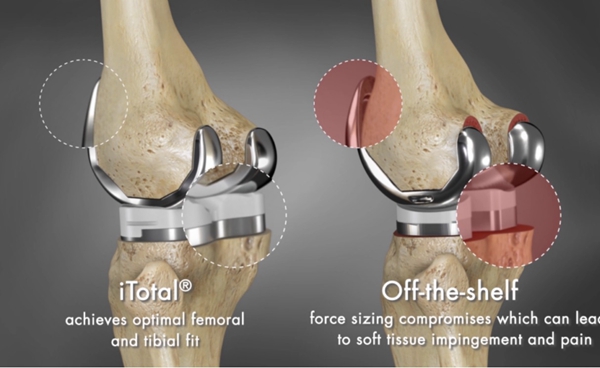

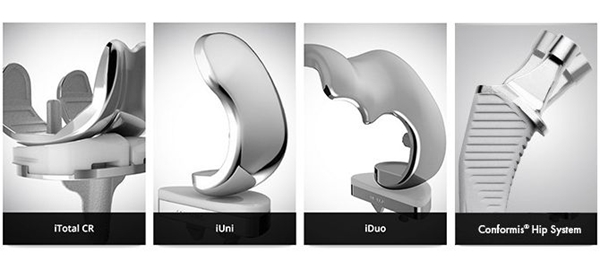

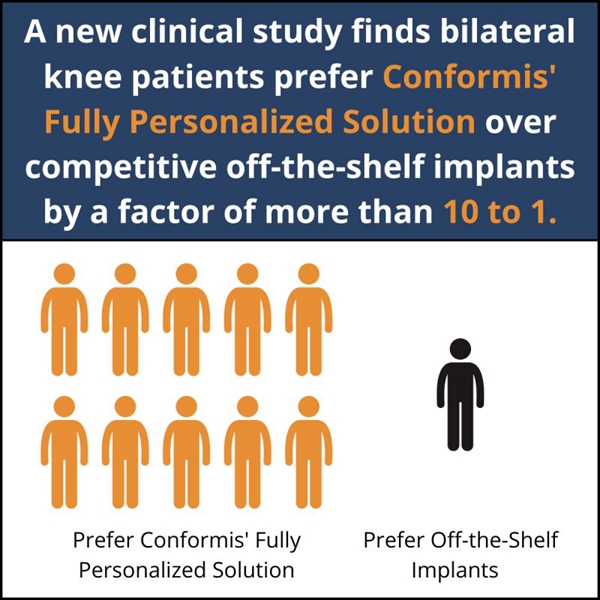

The company is made up ofPhilip LangDr. Yu2004Founded in 2006, it aims to revolutionize the way personalized joint implants are manufactured. The company focuses on creating products tailored to each patient’s individual needs, rather than asking patients to adapt.“off the shelf“Implants.

3DThe impression is alwaysCompliantKey to the custom joint replacement implant manufacturing process. althoughPhilip LangDr.2016resigned as CEO in 2016, resulting inCompliantthe stock price fell sharply46%but the company always insists on the development and application3DPrinting technology. This technology has beenCompliantThe heart of custom joint replacement implant manufacturing designed to provide individualized care solutions for each patient. Thus, despite the challenges, the company remains determined to promote3DDevelopments in printing technology.

furthermore,Compliantexist2019Years with medical technology giantsStrykersigned a deal worth up to3000million dollar deal. This protocol focuses onCompliantcustom instrumentation technology that usesCTScan to develop custom single-use instruments for knee replacements. In this agreement,StrykerAdvance payment commitment1400million, and will be available in key future phases for sales, licensing and development1600million dollars.

However,CompliantAndStrykerThey both signed an agreement and were involved in legal proceedings.CompliantThat’s rightWright Medical(CurrentlyStryker) filed a lawsuit for infringement of some of its patents. Finally, the two sides reached an agreement,Strykeragree toCompliantpay1500million US dollars (approximately1.07billion) to resolve patent disputes involving patient-specific shoulder devices. Despite this legal dispute, theStrykeraboutpsiThe five-year exclusive technology and distribution rights agreement was still in effect.

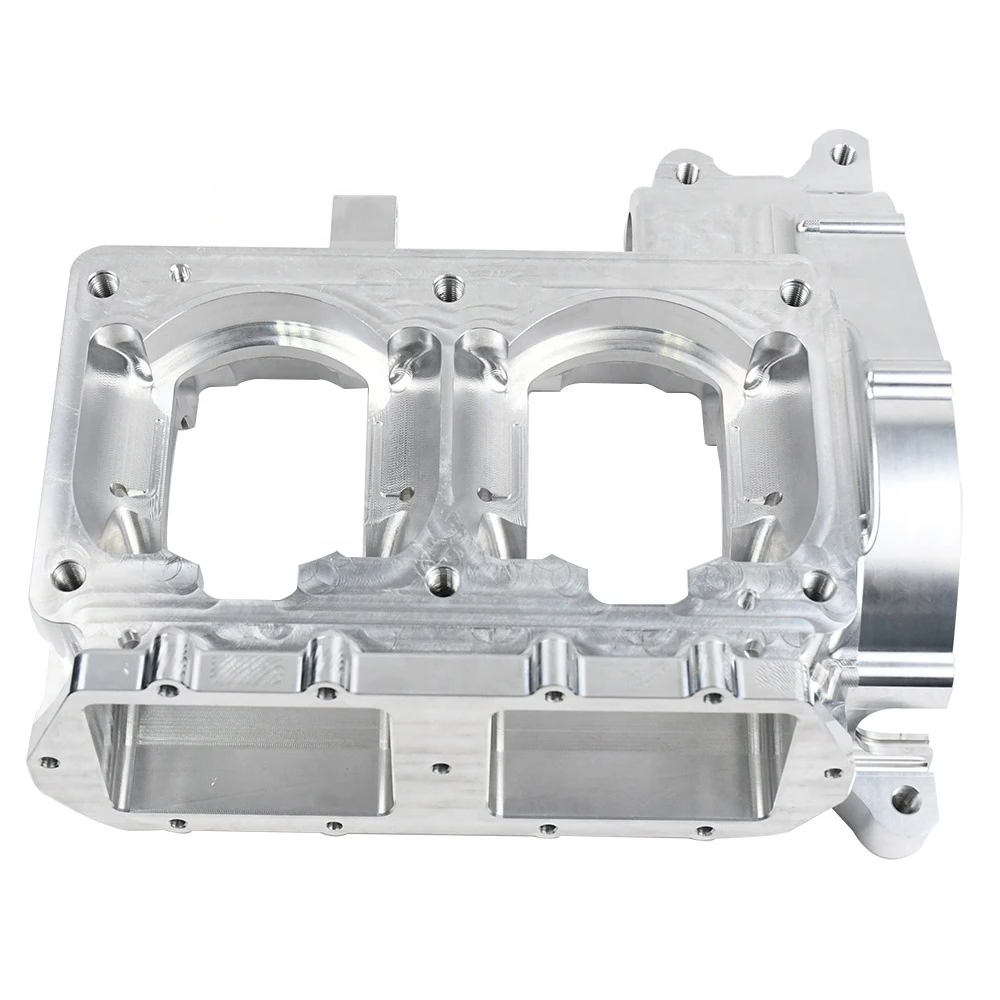

△Compliantof3DPrint an example implant

More opportunities and benefits from the merger

From a financial point of view,CompliantThe development process is like a roller coaster with ups and downs. The company was2015Year7Listed in March, the initial share price is15dollars and collected approx.1.35billion US dollars (approximately9.33billion) of funds. However, after the founder left, the company fell into turmoil and the stock price dropped to5.47Dollar. until2023Year,Compliantfinds itself faced with a series of dilemmas, with first quarter turnover of1280million US dollars (approximately9188million yuan), a year-on-year decrease18%. Despite these challenges, the company’s earnings per share(EPS)and revenues still beat analysts’ expectations, respectively.5%And2.1%。

2023Year6Beginning of the month,CompliantShare price falls to all-time low1.09Dollar. However, with the announcement of the acquisition, signs of change are being felt in the market. The stock price nearly doubled, demonstrating the market’s enthusiasm forRestore3dThere is a lot of confidence in this promising acquisition.

△CompliantHe said there is currently an increased demand for personalized medicine in the medical field.

Restore3dCEO ofKurt Jacobus“This merger will create a leader in personalization3DMedical device printing company. “By integrating both parties’ expertise in AI-driven implant design, digital automation and3DBenefits in printing osseointegrated biomaterials, both companies hope to provide clinically differentiated and cost-effective solutions across the entire orthopedic field.

CompliantCEO ofMarc AugustiHe also expressed enthusiasm for this new chapter for both companies and praised the value of their product portfolios, core technologies and intellectual property. He said the transaction would benefit all stakeholders and enableCompliantable to continue its mission of helping patients lead productive lives after knee or hip surgery.

at present,CompliantThe board of directors approved the transaction, which is expected to be completed by the end of the third quarter of this year. However, the specific trajectory will depend on the terms of the merger agreement and the strategic direction of the new entity.

Source: Antarctic Bear

Daguang focuses on providing solutions such as precision CNC machining services (3-axis, 4-axis, 5-axis machining), CNC milling, 3D printing and rapid prototyping services.