Among the many solutions aimed at improving energy efficiency, additive manufacturing technology is one of the most representative options, as more and more oil and gas companies turn to 3D printing to create complex geometries cost-effectively, especially when it comes to replacement. and spare parts. This article lists typical application cases of 3D printing in the energy sector by 12 representative major manufacturers currently in the market. The specific content is as follows:

3D Metalforge and Shell collaborate to manufacture heat exchanger components

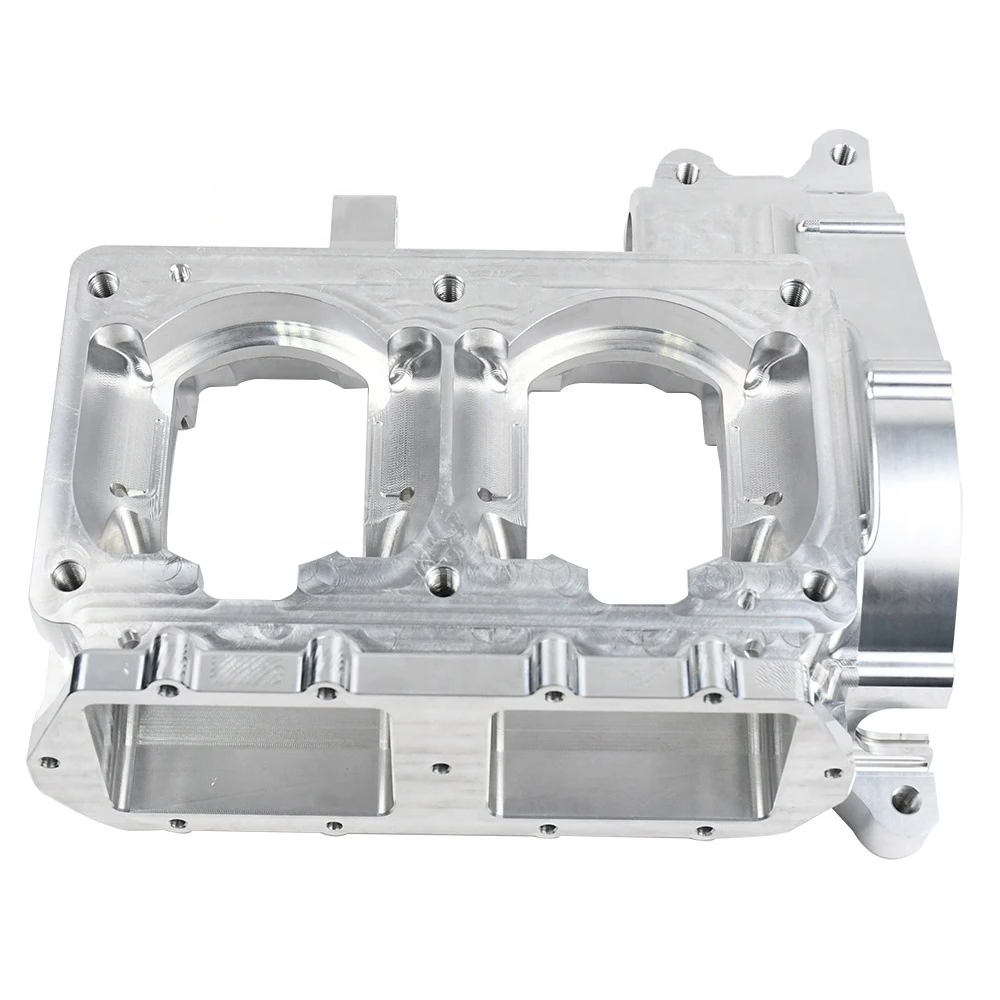

Shell, one of the world’s largest energy companies, has also moved toward additive manufacturing in recent years. In late 2021, 3D Metalforge announced a partnership with Shell Jurong Island, Shell’s specialist chemical manufacturing base in Singapore, to provide 3D printed heat exchanger parts. This unique agreement was achieved by Shell Jurong Island engineers to reduce the manufacturing time of heat exchanger tube components, a feat achieved in just two weeks through the application of 3D printing technology. Heat exchanger tube components are thin-walled tubes inserted into the inlet ends of condensers and heat exchangers to transfer heat and prevent tube failure. They are therefore essential components in the oil and gas industry. By applying additive manufacturing technology, Shell Jurong Island was able to extend the life of existing equipment, thanks to the rapid receipt of cost-effective spare parts.

△Photo source: 3D Metalforge

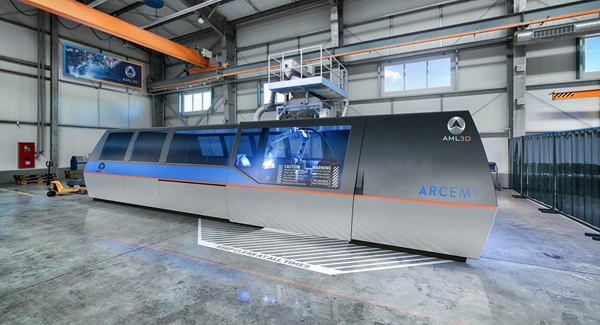

3D printed pressure vessel by AML3D

AML3D is an Australian manufacturer of metal 3D printers, particularly machines that rely on the directed energy deposition (DED) process. This summer, it announced a new project with the American oil company ExxonMobil. The project involves using 3D printing technology to design a metal pressure vessel 8 meters long, 1.5 meters in diameter and with a total weight of 907 kg. It is believed to be the largest 3D printed commercial container on the market. As AML3D’s technology is currently compatible with aluminum, titanium, steel and nickel alloys, AML3D estimates it can manufacture the part in just 12 weeks.

△AML’s 3DArcemy system

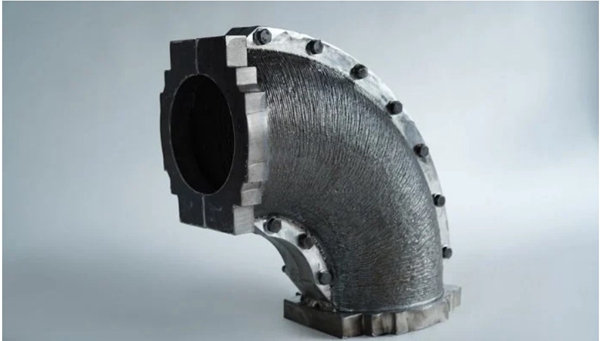

AML3D creates world’s largest oil and gas pipeline component

In another AML3D case study, the company has long been known for producing large metal parts with its Rapid In-Line Manufacturing (WAM®) process, derived from DED and combining an electric arc with certified welding wire . In November 2021, they used hybrid 3D printing manufacturing methods to create what they believe is the largest proven high-pressure metal pipeline component for oil and gas. Additive manufacturing was chosen because they wanted to reduce environmental, human and safety risks, and this is the first time in the world that this type of pipeline valve core component is 3D printed in metal and tested under pressure independently.

△Photo source: AML3D

Chevron Corporation

To address supply chain issues, Chevron, the world’s sixth-largest oil company, has also turned to 3D printing. For this, the American company used the services of Lincoln Electric, specializing in the manufacturing of production tools, including welding, plasma cutting solutions and 3D metal printing. Together, the two companies met Chevron’s on-demand production needs and produced eight nickel alloy parts, avoiding supply chain delays.

△Photo source: Lincoln Electric

General electricity

General Electric also turned to 3D printing for the oil and gas industry in 2018. The American company produces the largest and arguably most efficient gas turbine, called Harriet. As a result, efficiency was improved by 64%. Using additive manufacturing technology, GE is able to produce complex geometries such as cooling paths in gas turbine blades, and the design of engine combustion systems has also been optimized through the use of parts 3D printed metals. Maximum efficiency is achieved in particular by creating complex geometries, which allow engineers to improve the premixing of air and fuel in the turbine itself.

△Photo source: General Electric

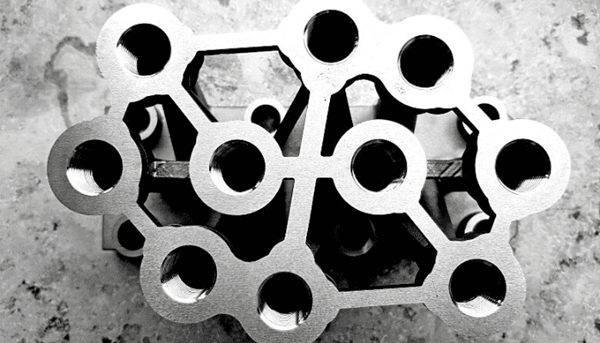

GKN hydraulic blocks

Director ümit Aydin, Head of Business Development at GKN, reported that GKN’s use of additive manufacturing in its design practice resulted in an 80% weight reduction in the hydraulic block subassembly (adapter block) . Using 3D printing in hydraulic applications is a great alternative to traditional manufacturing methods because they are lighter and customizable. This additive manufacturing process, combined with GKN technology, allows freedom of geometric design without the risk of overlapping holes. Additive manufacturing was chosen because it allows design adjustments to be made at any time, whereas with traditional methods, if hole positions need to be changed to optimize oil flow, new tooling is required.

△Photo source: GKN

Duct tape block created by Markforged

In another example of the diverse applications of 3D printing in the oil and gas sector, Markforged was approached by a Canadian integrated oil and gas company to create an automated processing machine capable of handling fiberglass strips. The company is struggling because the pads weigh between 52kg and 104kg, making them too heavy for one person to handle. However, the production cost of such a carpet processing machine is too high, although owning such a machine is expected to increase the factory’s production by 15%. Instead, they turned to Markforged Mark Two and continuous fiber 3D printing to create custom parts for the machine at a lower cost. Ultimately, the company was able to save CA$27,000 and demonstrate applications in the oil and gas sector beyond pipelines.

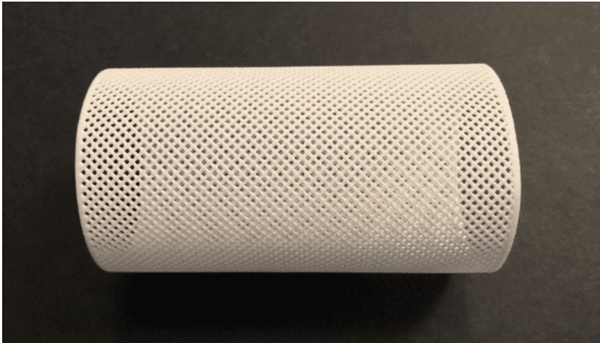

3D Printed Hose Clamps from MX3D

Additive manufacturing company MX3D developed a 3D printed hose clamp for the oil and gas industry in late 2021. The part was manufactured and tested by a collaboration between MX3D, Team Industries and TiaT. A hybrid approach was used, integrating MX3D’s wire-arc robotic additive manufacturing (WAAM) process. The 3D printed hose clamps have been tested and certified as highly safe, demonstrating how WAAM can be used in the oil and gas sector.

△Photo source: MX3D

PGV Petroleum Tool Company and Desktop Metal Company

PGV Oil Tools, located in the city of Cannes, is a manufacturing company specializing in the design and manufacture of downhole oil tools for over 30 years. The Texas-based company was founded in 1983 and manufactures equipment for many different industries, including the oil and gas, aerospace, robotics and automation sectors. While relying on traditional manufacturing methods such as CNC machining, the company also decided to apply metal 3D printing and fully exploit innovative additive manufacturing technology. To produce its oil downhole tools, PGV chose a tabletop metallurgical shop system that allows the company to produce tools at a lower cost and time than traditional methods. Additionally, using 3D printing technology can also reduce waste during production.

△Metal components for oil and gas 3D printed by PGV. Photo via Metal Desk

Space Parts 3D and Ocyan

The two companies, Spare 3D and Ocyan, have partnered to accelerate additive manufacturing in the oil and gas industry. Ocyan, a Brazilian company that provides solutions to the offshore oil and gas industry, has turned to Spare 3D, a French company based in Paris specializing in digital inventory of parts for additive manufacturing. They use the comprehensive DigiPART software, which can promote the application of additive manufacturing in spare parts manufacturing by reducing delays, lead times, minimum order quantities or inventory levels. They were able to integrate this software into their parts supply chain. This is already the first part that the company has established to create a common framework to chart a path for the adoption of additive manufacturing of spare parts. The work between the two companies consisted of analyzing 17,000 parts in Ocyan’s stock in order to assess their production potential by additive manufacturing. This resulted in viable coins representing 11% of all coins analyzed.

△Photo source: 3D spare parts

Vallourec and Total 3D printed offshore components

In May 2021, French partners Vallourec and Total announced for the first time the successful installation of a 3D printed water jacket in the North Sea. As a reminder, waterbushing is a component used in the oil and gas drilling industry to prevent wells from gushing oil and gas during construction. It is therefore a key factor in ensuring the safety of workers in the field. The two French groups therefore relied on additive manufacturing, in particular the WAAM process, to design a part 1.2 meters high and weighing 220 kilograms, which represents a 50% weight reduction.

△Traditional design water jet (Photo source: Vallourec)

VELO3D and DuncanMachine Products partner for the oil and gas industry

In 2020, additive manufacturing equipment manufacturer Velo3D announced a partnership with Duncan Machine Products (DMP), a major player in the oil and gas industry. Dedicated to providing high precision machining services, DMP is a significant supplier to the oil and gas industry as well as the aerospace industry. In Q2 2020, DMP took delivery of the complete Velo3D system, which includes Flow™ prepress software, Sapphire® 3D printer and Assure™ quality management software. “Given the complex technical requirements, metal additive manufacturing is a compatible process for the oil and gas industry,” said Benny Buller, CEO and founder of Velo3D. With this metal 3D printing solution, DMP aims to meet growing market demand, increase the production of final parts and shorten delivery times.

source:

Daguang focuses on providing solutions such as precision CNC machining services (3-axis, 4-axis, 5-axis machining), CNC milling, 3D printing and rapid prototyping services.