Text: China Machine Tool Association

Since 2021, the global planning of my country to promote the prevention and control of the epidemic and economic and social development, the economy has continued regularly and the quality of development has been further improved. In good macroeconomic conditions, the machine tool industry has continued to recover the trend since the second half of 2020, market demand continued to improve, entry and exports have increased considerably and the operation of The machine tool industry continued to maintain a good trend.

1. Basic operation of the industry

According to the statistics of the contact key of China Machine Tools Association, as well as the information provided by the company’s survey and certain branches, the operation of the machine tool industry will be analyzed as follows.

From January to October 2021, the overall operation of the industry has always maintained regular growth. The increase in annual shift was even higher.

1. The operating profit generally increases considerably

From January to October 2021, the operating profit of companies increased by 31.6% in annual sliding, and the increase dropped by 2.7 percentage points from January to September. The operating profit for each segment has increased significantly by the year. Among them, metal cutting machines increased by 35.3% of metal-shaped machine tools, in metal, increased by 21.5% over one year, and the amount of work increased by 17.7% of the year. Abrasives increased by 33.6% of surn years.

2. Each industry section has fully reached profitability

From January to October 2021, focusing on the total benefit of companies increased considerably in annual shift, and all industries have all reached profitability. The machine tool industry has been improved for a long time.

3. The year of the year to orders is higher

From January to October 2021, new orders for the company’s processing tools of the company increased 29.4% in annual sliding. At the end of October, orders in hand orders increased by 22.4% of the year. Among them, the new commands of metal cutting machines increased by 28.9% over one year, and the control in hand -up commands increased by 12.8% of the year; -Year, and the order in manual orders increased by 48.6% years -Year. Metal-shaped machine tools have a high-year growth rate on an order of the year in the hands, throwing a good base for the stable operation of the next step.

4. The release of machine tools has increased considerably and the inventory of finished products has decreased

According to data published by the State administration, from January to October 2021, the release of metal cutting machine tools was 492,000 units, an increase of 31.9% in annual sliding; 6.1% in annual shift.

According to the statistics of the emphasis on the associations of the association, from January to October 2021, the release of metal cutting machines increased by 27.4% in annual sliding and the production value increased by 37, 7% in annual shift; Metal molding machines increased by 23.0% in annual sliding and the production value increased by 27.0% in annual sliding. The rate of growth in the above output value is significantly higher than the growth rate of the corresponding production, indicating that the value of the unique machine tools has increased.

From January to October 2021, the inventory of companies increased by 11.6% in annual shift. Among them, raw materials increased by 19.0% over a year, and finished products increased by 2.1% years over a year. The inventory of metal processing machines products increased by 6.7% over a year. Among them, metal cutting machine tools increased by 7.3% Annal-Year, and metal machine tools increased by 3.3% years on

2. Import and export situation

According to data on Chinese customs, from January to October 2021, the import and export of machine tools continued to grow quickly in the first half and continued to grow quickly. The total import and export value of 26.95 billion USD increased by 32.2% of the year. From January to October 2021, the import and export of machine tools have maintained an excess situation since June 2019, with a surplus of $ 3.90 billion.

In terms of imports, from January to October 2021, the overall increase in significant growth. Importing machine tools imported from $ 11.52 billion, an increase of 23.1% of the year. Among them: the volume of importation of metal treatment machines was $ 6.20 billion, an increase of 27.1% per year (including the amount of importation of metal cutting tools was 5, 18 billion dollars, an increase of 29.1% -NE -Year; Year -Year). The amount of importing of the cutting tools was 1.39 billion US dollars, an increase of 16.7% of the year. Abrasive and abrasive imports were $ 630 million, an increase of 26.8% over one year.

The first five in terms of metal treatment machines are: $ 2.26 billion in the treatment center, representing 36.5%; 11.9%; Lathes of US 490 million dollars, US $ 490 million, US 490 million dollars, US 490 million dollars and US $ 490 million, US 490 million dollars, US $ 490 million and 490 million US Dollars, 490 million dollars, 490 million US dollars and 490 million US dollars, US $ 490 million, US 490 million and 490 million US dollars, US $ 490 million and 490 million US dollars, 490 million US dollars and US $ 490 million, US 490 million dollars and US $ 490 million.

From January to October 2021, the three main import sources were: $ 3.78 billion in Japan, an annual 34.1% increase; $ 1.56 billion, an increase of 34.4% in annual sliding.

In terms of exports, from January to October 2021, he continued to maintain a significant growth trend. The machine tools were exported to $ 15.43 billion, an increase of 39.8% of the year. Among them, the export volume of metal treatment tools was $ 4.24 billion, an increase of 33.9% of the year on the point (whose export value of the export value Metal cutting machine tools was $ 3.23 billion, an increase of 33.9% -ON -Yar; Increase of 33.8%-Sur themselves). The export value of the cutting tool was $ 3.11 billion, an increase of one year of 36.4%. The abrasive export amount was $ 3.30 billion, an increase of 63.2% over one year.

The five main exports of metal treatment machines are: US $ 1.33 billion in special treatment machine tools, representing 31.4%; For 7.8%; 290 million US dollars, representing 6.7%;

From January to October 2021, exports to the first three were: 1.95 billion US dollars in the United States, an increase of 26.5% in annual shift; ; 1.0 billion US dollars from India, an increase of 62.8% in annual shift.

3. In the first half of 2021, the operation of listed companies in the machine tool industry

The listed companies in the machine tool industry have concentrated a number of high-quality companies typical of the industry. The operation of this business group is very important to analyze and judge the development of the industry.

We select 53 companies with exceptional industry characteristics as key surveillance and analysis items for companies listed by industry. Of these 53 listed companies, there are 22 boards of directors of the Shenzhen Stock Exchange, 18 gems; 6 main tips on the Shanghai Stock Exchange and 7 scientific and technological advice.

Among them, 30% of metal cutting machine tools, 8% of metallic machine tools, 13% of business companies, 26% of abrasives, 11% of CNC devices, 8% machine tool accessories and functional components.

At the end of the first half of 2021, the total assets of listed companies which was monitored totaled 218.12 billion yuan, an increase of 8.9% compared to the beginning of the year. The total liability totaling 107.65 billion yuan, an increase of 11.2% compared to the start of the year. The active-responsibility ratio was 49.4%, an increase of 1 percentage point at the start of the year.

In the first half of 2021, the main follow -up of listed companies reached a total of 52.81 billion yuan in operating profit, an increase of 40.5% by one year of 40.5%. The total cumulative profit was 5.43 billion yuan, an increase of 53.6% years over a year. The cumulative net profit was 4.64 billion yuan, an increase of 62.3% of the year. The losses in the first half of 2021 were 13.2%, one year a year in narrowing of 7.6 percentage points.

The benefit of the company’s income from the listed company focused on monitoring was 10.3% in the first half of 2021, an increase of 0.9 percentage point of the year over one year and companies 64.2% over one year on companies of 64.2%.

From the data of assets, operating profit and profits from listed companies which are monitored above, the overall operation of the companies listed in the machine tool industry in the first half of 2021 has improved considerably by relation to the same period of the previous year. However, based on absolute data of indicators such as beneficiary margins and average yields of net significant assets, the profitability of most companies is still low.

4. Industry operating characteristics

1. The functioning of the entire industry continues to maintain stable recovery and growth

Judging by the above statistics, the overall machine tool industry and the main indicators of the 10 months before 2021 have reached significant growth in the main indicators, and profitability has been improved. The machine tool industry maintains a relatively stable recovery and growth trend as a whole.

2. Importing and exporting machine-tool products develop continuously

In the first 10 months of 2021, import and export products of machine tools increased significantly by the year, on export growth, export growth was much higher than the rate of import growth, and the commercial surplus continued to develop. The import and export of metal treatment machines have completely reversed the negative growth trend in the previous two years.

3. The situation of the metal treatment machinery order is rewarding

From January to October 2021, metal-treatment machine tool orders have maintained a strong trend in annual sliding growth. Among them, the metal-shaped machine tool industry is much higher than the growth rate of the year on the order of the hands of the year than the metal cutting machine industry, this which indicates that the recovery and growth of the industry should accelerate.

4. Listed companies have increased rapidly, but the profitability of most companies is always low

From data from various indicators such as assets, operating profit and profits, overall functioning of companies listed in the machine tool industry in the first half of 2021 has improved considerably compared to the same period of the previous year. However, from the point of view of the beneficiary margins, the profitability of most companies is still low.

5. The injustice of the industry has increased

Since 2021, the epidemic has been repeated several times on several occasions on several occasions, natural disasters are frequent, the prices of industrial raw materials have increased, international logistics are limited and the increase in export costs has caused a Large impact on the functioning of the machine tool industry. At the same time, under the influence of the epidemic in the country and abroad, the industrial structure is unreasonable and certain weak links of the industrial chain and the supply chain are prominent.

Recently, the problem of significant price increases and industrial raw materials has been relieved, but the subsequent impact on the operation and demand of the machine tool industry cannot be ignored.

5. In 2022, the prediction of the situation in the machine tool industry

During the first 10 months of 2021, market demand in the machine tool industry was relatively strong, the operation of the industry was restored regularly and the growth trend was obvious. The industry in 2021 will increase the year in terms of 20%.

Due to the impact of the basic effect caused by the epidemic in 2020, the association focused on the annual growth rate of operating income for annual monthly profit in 2021 decreased per month. The monthly growth of the month over the month was maintained in the first half.

From the point of view of the macroeconomic environment, since the second half of 2021, the risks in the country and abroad have increased, the world epidemic has spread, the time of the global economic recovery has slowed down, prices international raw materials have increased and certain domestic regions The areas have been affected by multiple impacts of epidemic and flood conditions. After the Chinese PMI manufacturing was located above the critical point for 18 consecutive months, it was located in the contraction beach in September and 10 in 2021 and returned to the critical point in November, 50.1%. During the first 1121, the growth rate of the investment of fixed assets throughout the company was 5.2%, including the growth rate of investment in fixed assets in the second industry was 11.1% , the growth rate of investment in fixed assets and equipment was – 3.7%, and the increase in the investment of fixed assets in the manufacture of automobiles The speed is -3.2%, which are all lower than recent years. At the same time, in recent months, some users of the machine tool industry have fluctuated.

In 2021, the Central Economic Labor Conference underlined: “The economic development of my country faced a narrowing of demand, an impact on supply and to weaken triple pressure”. Regular growth will be an important task in 2022. It is necessary to increase the intensity of expenditure, to accelerate the progress of spending and to invest in moderate infrastructure in moderation. Reunion proposed that all regions and departments should be responsible for stabilizing macroeconomic policies and actively launching policies conducive to economic stability in all aspects, and politics is properly advanced.

2022 is the second year of the plan for the “Fourteenth Plan of five years”, and the 20th National Congress of the Party will be held. We can expect the level of policy to promote economic growth exceeds the perennial year, which will also greatly draw demand from the market-tool tool.

Complete examination of various favorable and unfavorable factors, it is expected that the machine tool industry of my country will continue this year’s right operation in 2022. However, due to the high number of bases in 2021, the main Indicators such as operating profit in 2022 can be equal to 2021 or slightly grow in 2021.

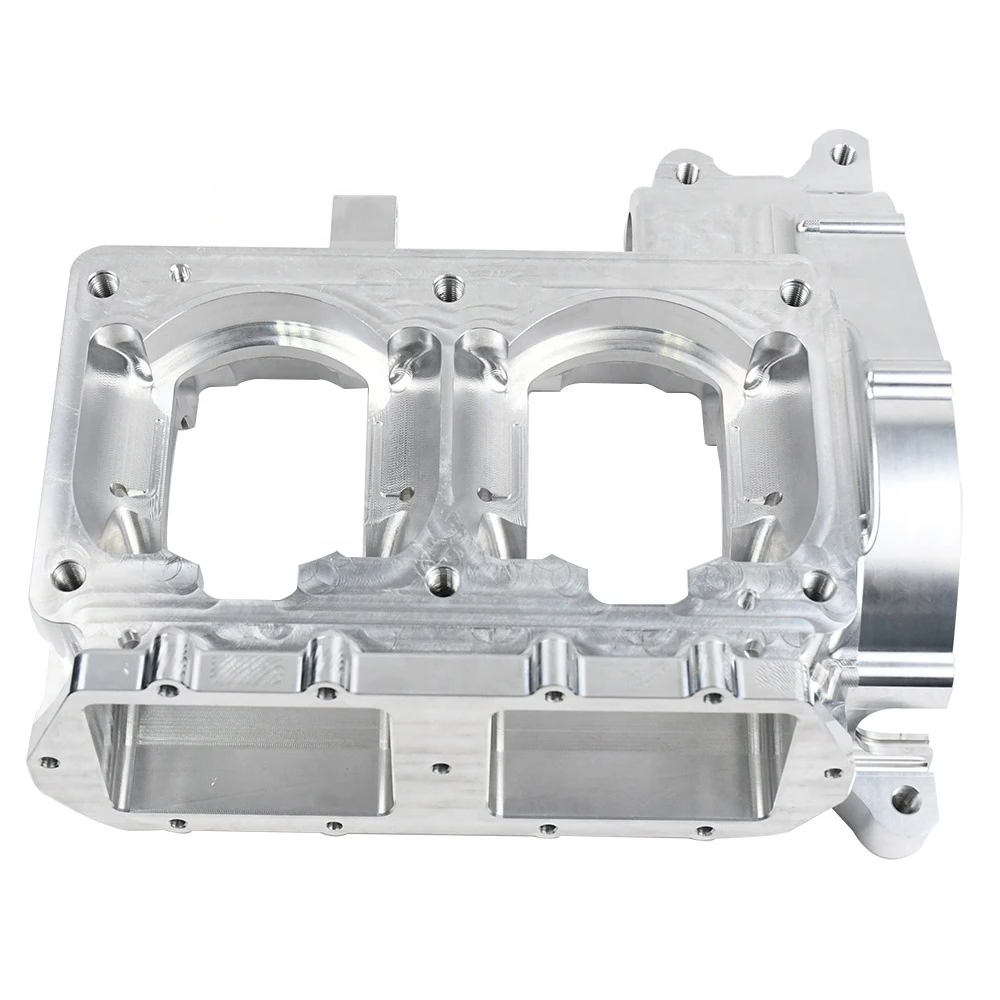

Daguang focuses on providing solutions such as precision CNC machining services (3-axis, 4-axis, 5-axis machining), CNC milling, 3D printing and rapid prototyping services.