In the first half of 2022, faced with the complex national and foreign environment, my country has effectively coordinated the prevention and control of the epidemic and the development of economic and social development. Over the past six months, the machine tool industry in my country has overcome negative factors such as the impact of the serious epidemic and has obtained relatively good operational results.

1. Basic operation of the industry

Under the direction of the Central Economic Labor Conference in December of last year, the national economy began at the start of this year. The trigger for the conflict of Russia and Ukraine in February has indirectly brought a negative impact. At the end of March, the triggering of the epidemic broke out in many places in Shanghai, Beijing, etc., and still had an impact on the production and functioning of companies in the machine industry. With the effective implementation of the country’s series of measures to promote consumption and stabilize growth measures, emergence and production of Shanghai and other areas such as serious epidemics showed signs of stability in June .

1. The operating result is fundamentally the same as the same period last year

In the first half of 2022, China Machine Tools Industry Association focused on the business operating income of 0.2% years over a year, which was fundamentally the same as the same period last year. Among them, metallic cutting machine tools fell 8.4% years on the metal-shaped machine tool industries increased by 24% over a year.

2. The growth rate for total profit is higher

In the first half of 2022, the total profit of the total contact of the company increased by 38.8% over one year. Among them, the metal cutting machine tool industry increased by 28.1% over a year, on the metal machine tool industry increased by 60.6% over one year, and industrial volume of the industry decreased by 9.3% in years.

3. The loss is slightly greater than the same period last year

In the first half of 2022, the proportion of losses in the associations of the association represented 27.3%, an increase of 1.2 percentage points compared to the same period last year. This can be linked to factors such as the impact of the epidemic in the local area and changes in the demand of certain market segments.

4. The decrease in the order of metal cutting machine tools and the metal machine tools have maintained growth

In the first half of 2022, the new orders for the machine tools for the processing of the company’s metals decreased by 8.2% over one year, and the order in hand-up commands increased by 5.1%- On the same way. Among them, the new commands of metal cutting machines decreased by 17.3% of years -YONS and by 3.1% of years -A -YEAR in hand orders. New metal machine tool commands increased by 14.7% over a year and, and control in hand-up commands increased by 25.2% in the years. The order of the metal molding machine is better than the metal cutting machine.

5. The release of machine tools decreased the year over a year, and the inventory increases full growth

According to data published by state administration, in the first half of 2022, the production of corporate metal cutting tools was 290,000 units, a 7.3% decrease in the machine or Metal machine tool units was 104,000 units, a year, a year -A -Ear decrease of 11.1%.

According to business statistics, in the first half of 2022, the release of metal cutting machines decreased by 14.7% of years -a -yar, and the output value decreased by 1% -Year; The machine tools decreased by 9.8% annual over one year, and the output value increased by 30.9% of the year on the case. The significant differentiation of the production and direction of the output value is linked to factors such as the increase in the single value brought by upgrading of the product structure and the rise in prices of material materials first.

In the first half of 2022, the companies inventory increased by 16.2% over a year. Metal treatment machines increased by 15.6% year -Year, whose metal cutting machines increased by 15.8% years and metal machine tools increased by 14, 5% Annyle -Oin -Year.

2. Import and export situation

According to Chinese customs data, total import and export of the machine tool industry from January to June 2022 was 16.38 billion US dollars, an increase of 3.5% in annual shift . Among them, total imports were $ 6.33 billion, a decrease of 9.1% over one year; Imports have decreased significantly and exports have maintained double -digit growth.

From January to June 2022, the import and export of machine tools have maintained an excess situation since June 2019, with a surplus of $ 3.73 billion. Among them, the surplus of trade has grinding abrasives, carpentry machine tools, cutting tools, metal training machines, flowing machines, measurement instruments, machine function components- tools and other products.

In terms of imports, from January to June 2022, it has generally decreased significantly. Among them, the import volume of metal treatment tools was $ 3.35 billion, a decrease of 9.8% per year. Among them, the importing volume of metal cutting machines was 2.84 billion US dollars, a decrease of 8.6% of the year in the form of a reduction in metal machines was $ 510 million. 15.6%. The amount of importation of the cutting tools was $ 770 million, a drop a year over one year out of 9.9% and the import amount of the abrasives was $ 380 million, an increase of 1.5 % years on the case.

From January to June 2022, the first five imports of metal treatment machines were: 1.23 billion US dollars, representing 36.8%; File, representing 12.8% of 12.8%;

From January to June 2022, the first three sources of importation of machine tools were: 2.07 billion US dollars in Japan, a drop from one year over the other of 12.2%; decrease of 2.7%; Taiwan, China, 850 million US dollars, an annual drop of 7.3%.

In terms of exports, from January to June 2022, exports have increased considerably. Among them, the volume of export of metal treatment tools was 2.79 billion US dollars, an increase of 13.8% over a year. Among them, the export volume of metal cutting machines was $ 1.96 billion, an increase of 15.4% over a year; sur-year. The export value of the reduction tool was 1.92 billion US dollars, an increase of 8.6% of the year over one year, and the abrasive grinding equipment was 2.27 billion US dollars, an increase of one year by one year of 21.8%.

From January to June 2022, the first five of the exports of metal treatment tools were: 880 million US dollars in special treatment tools, representing 31.5%; The formal machine tools were 20 million US dollars, representing 7.2%; The treatment center was $ 196 million, representing 7.0%.

From January to June 2022, the export of machine tools was: $ 1.28 billion in the United States, an increase of 17.0% in annual shift; 670 million US dollars, an annual sliding drop of 12.0%.

3. Industry operating characteristics

1 and 1 The machine tool industry is more affected by the epidemic situation

During the first half of this year, the domestic epidemic was released. Companies in the machine tool industry are relatively concentrated. Some companies have been closed for a long time and have even completely interrupted production, which has caused major losses to the production and exploitation of the company.

Since the epidemic involves a wide range of scope, companies other than the areas of the epidemic are also greatly affected. It is mainly reflected in market demand for epidemic deletions, information and market orders are reduced, sales have decreased; Soon.

The main associations of the association clearly reflect the impact of the epidemic on the machine tool industry. After March this year, the cumulative value of operating income from the machine tool industry decreased the month over the month and the impact of the epidemic emerged gradually. The impact of the epidemic in the 4th and 5th month, and the monthly operating profit has decreased significantly from the year -NE -Year and from month to month. The monthly operating profit in June has always decreased a little by a year, but the increase of more than 20% per month, which reflects control of the epidemic situation, and the results of the reconsolors and the reduction obtained results. However, the operating result of January and June in January and June has slightly decreased in annual sliding, which indicates that the impact of the epidemic has not completely eliminated.

2. The level of profit of the industry has maintained good growth

In the first half of this year, total profit increased well in the first half of this year. There are three main reasons: first, due to the increase in high demand and the acceleration of its inner alternative process. The level of user demand levels, in particular the acceleration of automation and computerization, under the impact of epidemic conditions, favored the general increase in R&D investment. Improving product technology content has motivated the improvement in the level of profit;

3. Deepen imports and exports continue to grow

During the first half of this year, imports and export products of machine tools had differentiated, and total imports decreased by 9.1% over one year, an increase of 6.8 percentage points per compared to the decrease in the first quarter; Increase of 13.5% over one year, a decrease of 6.1 percentage points compared to the first quarter. The trend of simultaneous growth and growth in imports of imports and exports last year changed. The decrease in imports and the growth of exports mainly reflect changes in market demand.

4. Metal-shaped machine tools develop quickly in industry

During the first half, the metal-shaped machine tool industry maintained rapid growth, efficiency increased quickly and market demand continued to grow. The association focuses on operating income from the metallic machine tool industry in the company of 24% annual, on total profit, total profit increased by 60.6% over one year, The new orders increased by 14.7% -Ear, and the order in manual orders increased by 25.2% of years -NE -Ane. New orders and commands in hand have been increased by the year over the years. The growth in orders is mainly due to the motivation of the new energy automobile industry.

5. The increase in the increase in the inventory of production products should be attracted

In the first half, the various company inventory indicators experienced an increase in two figures for the year over a year. The current increase in the inventory of finished products is mainly due to the impact of epidemic conditions and the weakening of market demand. In the near future, the increase in the inventory of raw materials is still reasonable, but the increase in the inventory of finished products should be considerably increased from the year over one year. Industry companies should pay attention and take corresponding measures to reduce stocks and revitalize funds.

4. Perspectives for the situation of the industry operation in the second half

From a macro, it was affected by super-affected factors such as the complex evolution of the international environment and the impact of the national epidemic since this year, and the downward pressure on the economy increased, however. stabilized and plump. Although economic functioning in the second half of the year is always faced with more difficult challenges, the long -term fundamental principles of the economy of my country have not changed. With the effectiveness of a series of stable growth policies and measures, the national economy should gradually recover and maintain regular growth. At the end of July, the meeting of the central political bureau determined the objective of economic work in the second half to maintain economic functioning in a reasonable range and endeavor to obtain the best results.

From the point of view of certain pilot macroeconomic indicators, the index of the Manufacturing Purchasing Manager (PMI) fluctuated from the line of wounds this year, with 49.0% in July and in the contraction range. From January to June, investment in fixed assets across the company increased by 6.1% in annual shift. Among them, high manufacturing investment in the machine tool industry increased by 10.4% over a year, the investment of automotive manufacturing investment increased by 8.9% over one year and the Investment in fixed assets of equipment and equipment increase of 2.4% of the year on the case. Global investment has remained regular growth.

In complete situations, the current demand and investment of the market are still low, the uncertainty of international trade is important, the main supporting pieces abroad are tightening, the raw materials are high and the impact of The epidemic is difficult to predict. However, with the regular growth of governments at all levels and the implementation of various policies and measures for market entities, the macroeconomic environment of industry operations will become better and better. Of the main associations of the association in the judgment of statistics of June, the global trend of industry stability is obvious.

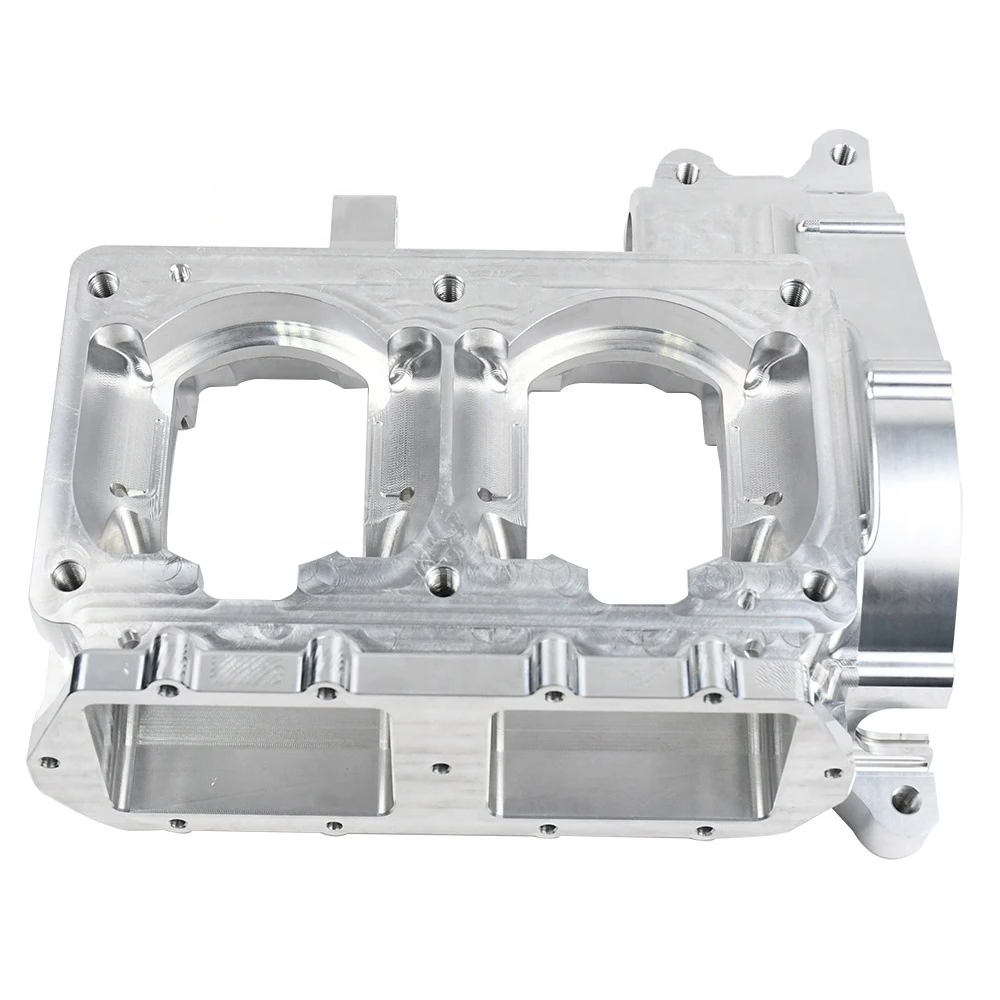

Daguang focuses on providing solutions such as precision CNC machining services (3-axis, 4-axis, 5-axis machining), CNC milling, 3D printing and rapid prototyping services.