CNC (Computer Numerical Control), also known as “industrial mother machine”, is one of the most important tools in industrial production. It provides intelligent production equipment and parts for the equipment manufacturing industry and is the cornerstone of the entire industrial system. Status.

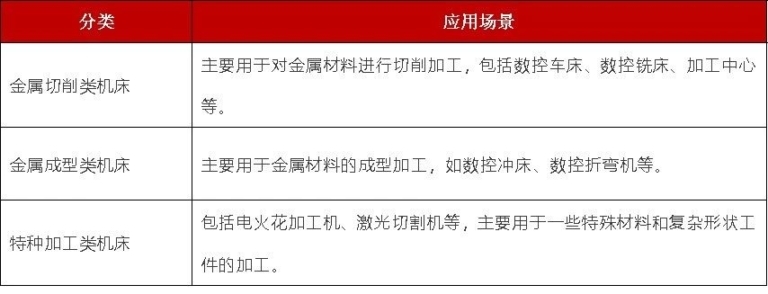

CNC machine tool is the abbreviation of numerically controlled machine tool. It is an automated machine tool equipped with a program control system. The control system can logically process programs with control codes or other symbolic instructions, decode them, express them with coded numbers and input them into the digital control device via the information carrier. Compared with traditional machine tools, CNC machine tools have significant advantages in processing precision, processing efficiency, processing capabilities and maintenance. According to different processing methods and application fields, CNC machine tools can be divided into metal cutting machine tools, metal forming machine tools and special processing machine tools.

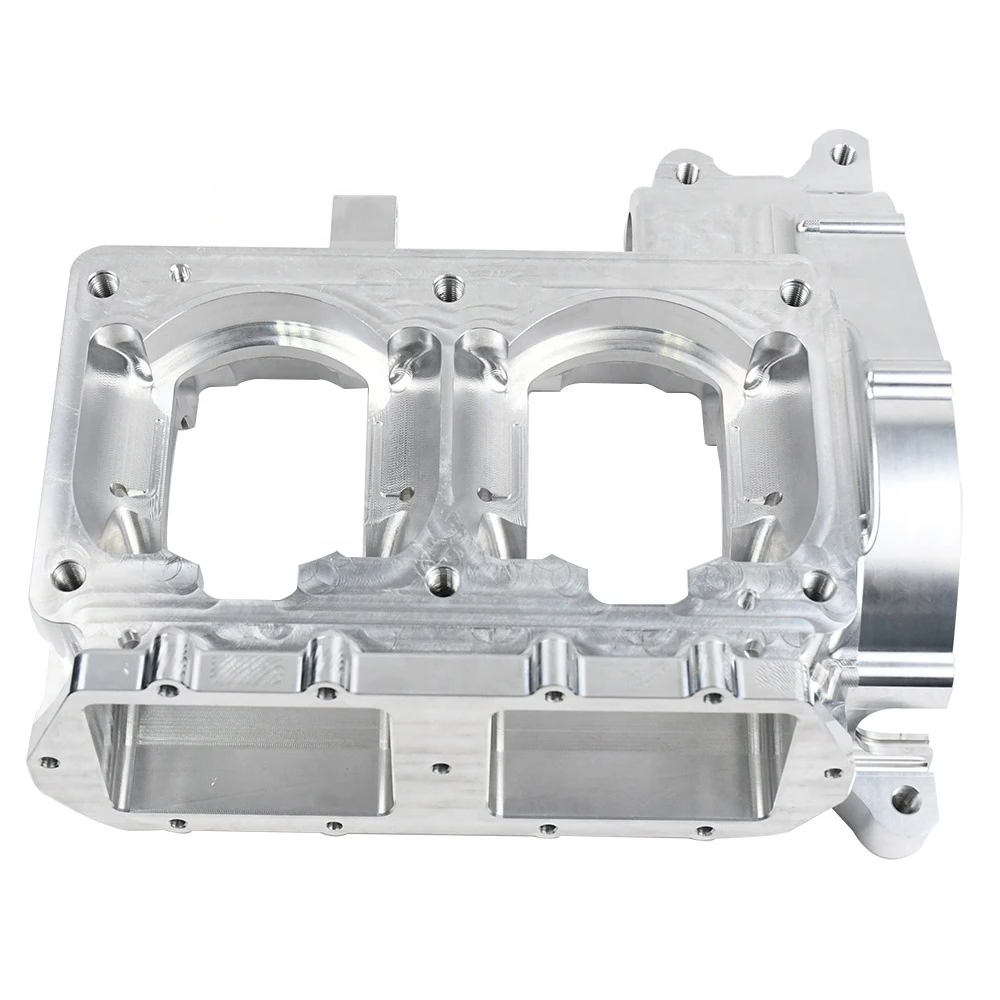

As an important equipment in modern manufacturing industry, CNC machine tools are widely used in various industries from automobile manufacturing to aerospace, engineering machinery to mold making due to their high precision , their high efficiency and their high automation.

01

Understanding the CNC machine tool industry chain

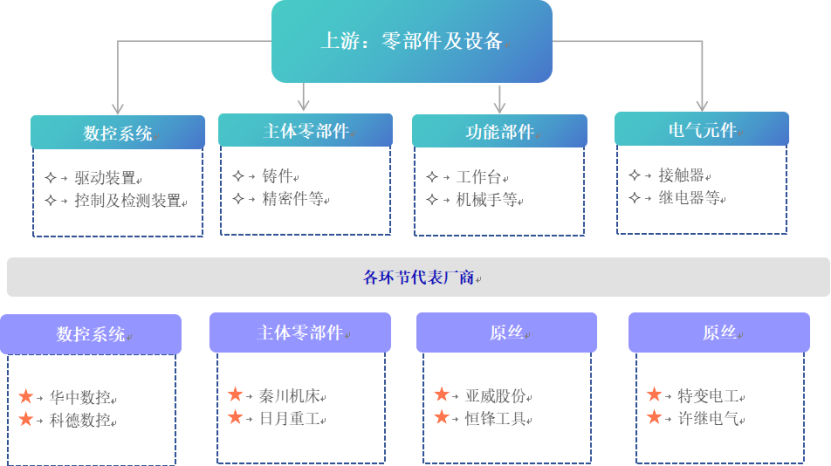

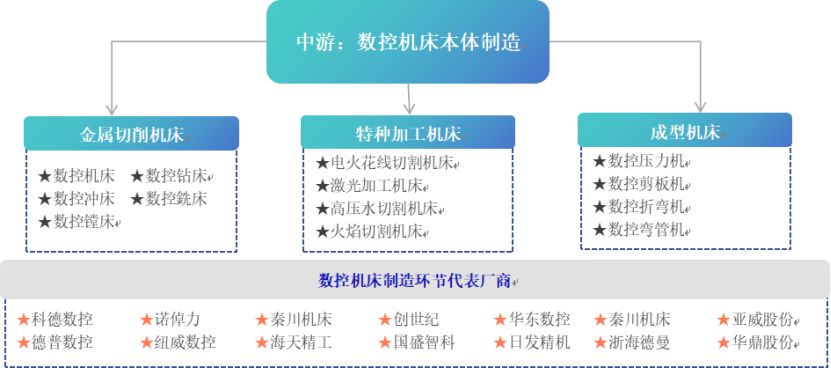

The CNC machine tool industrial chain is divided into three parts: upstream, middle and downstream, and each link complements each other. The upstream mainly includes various equipment components required for CNC machine tools, including CNC systems, core components, functional components, electronic components, etc. The midstream industry mainly includes various CNC machine tool products, which can be divided into CNC metal cutting machine tools, CNC metal forming machine tools and CNC special processing machine tools. Its downstream application areas include automobile manufacturing, aerospace equipment manufacturing, shipbuilding, mold manufacturing, power generation equipment manufacturing, metallurgical equipment manufacturing and metallurgical equipment manufacturing. communications equipment.

Upstream of the industrial chain: machine tool parts

Upstream mainly includes suppliers of CNC systems, machine tool main components, functional components and electrical components. CNC system is the main component of CNC machine tools, including hardware and software parts. The market is mainly occupied by international giants such as Siemens, HEIDENHAIN, FANUC and Mitsubishi. The main components of machine tools include bed, spindle, etc., which are the basic components of CNC machine tools. Functional components include guide rails, ball screws, etc. Their quality is an important guarantee for the performance and quality of intelligent manufacturing equipment. such as CNC machine tools. Overall, the market structure for precision parts, functional components and CNC systems is stable, with little price fluctuations.

From the perspective of cost proportion, the cost of structural parts (including the bed, slide, workbench, etc. that support the machine tool) accounts for about 35%; the cost of CNC system (basic control components) accounts for about 30%; %; the transmission system (auxiliary machine tool) The cost of moving parts (including spindles, guide rails, screws, etc.) accounts for about 20% of the cost of the drive system (including motors and spindle drives, etc.) represents approximately 13%.

Key upstream components rely heavily on imports, and localization development is relatively slow, CNC systems and transmission systems mainly rely on imports, while core functional components such as turntables, magazines tools and tool turrets depend partly on imports, and some. use national brands. “Made in China 2025” aims that by 2025, the localization rate of standard CNC systems, intelligent CNC systems, spindles, screws and guide rails will reach 80%, 30%, 80%, respectively. 80% and 80%. There is still a lot of room for improvement.

In the middle of the industrial chain: manufacturing of CNC machine tool bodies

The middle sections of the industrial chain include various types of CNC machine tool products, which can be mainly divided into CNC metal cutting machine tools, CNC metal forming machine tools and CNC special processing machine tools. The middle link is the manufacturing link of CNC machine tools, involving the design, assembly and debugging of machine tools.

As a typical mechatronics product, CNC machine tools are a combination of mechanical technology and CNC intelligence. They can be divided into metal cutting machine tools (turning, milling, boring, drilling, grinding, etc.), forming machine tools (presses, shears, bending). machines, etc.) machines, etc.), special processing (wire EDM machines, EDM forming machine tools, etc.), machining centers (multi-axis linkage, flexible processing units) and other products .

Chinese CNC machine tool companies are mainly positioned in the middle and low-end market. Although the penetration rate of high-end products is increasing, it still remains at a low level. At present, the localization rate of my country’s mid- and low-end CNC machine tools is 65% and 82% respectively, and the localization rate of high-end CNC machine tools is only by 6%. High-end CNC machine tools.

CNC machine tool manufacturers mainly include Huadong CNC, Genesis, Haitian Precision, Rifa Precision Machinery, Qinchuan Machine Tool, Zhejiang Heidemann, Shenyang Machine Tool, Yawei Co., Ltd., Huading Co., Ltd., etc.

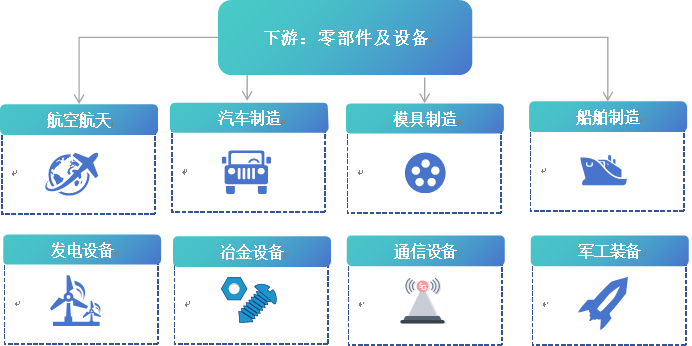

Downstream of the industrial chain: sectors and scenarios

Downstream is its application area, mainly including downstream channels and application scenarios. CNC machine tools are used in a wide range of applications, including automobile manufacturing, railways, ships, aerospace and other transportation equipment. Among them, automobiles are the main downstream demand area, accounting for about 40% of applications; followed by aerospace applications, which account for around 17%, and molds and engineering machinery, which account for around 13% and 10%, respectively. The demand for CNC machine tools in these industries is large and demanding, which has continuously promoted the continuous improvement of CNC machine tool technology.

Representative enterprises in the downstream industrial chain include leading enterprises in major manufacturing industries such as Guangzhou Automobile Group, Aviation Engine, Great Wall Motors and Dongshan Precision.

02

CNC machine tool industry breakdown map

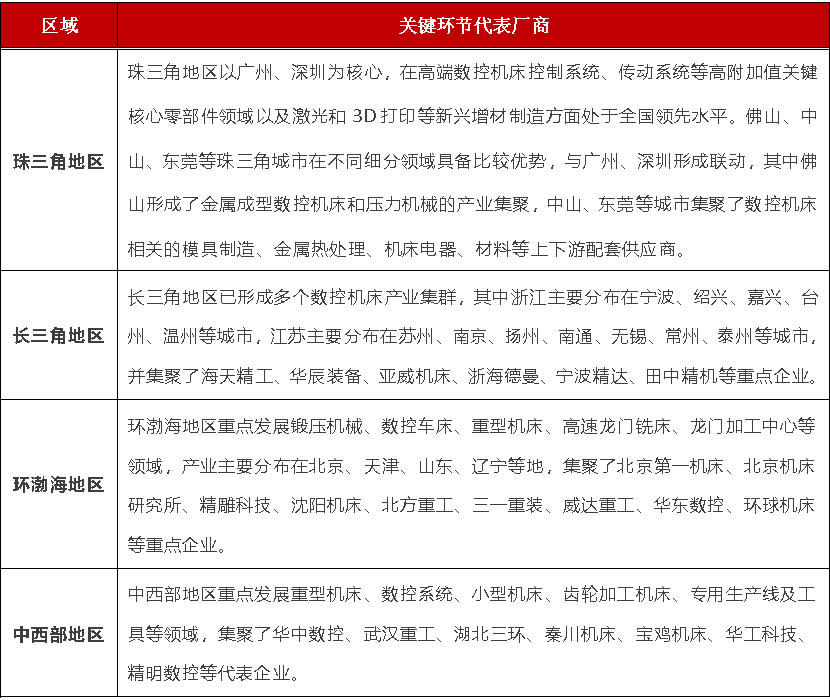

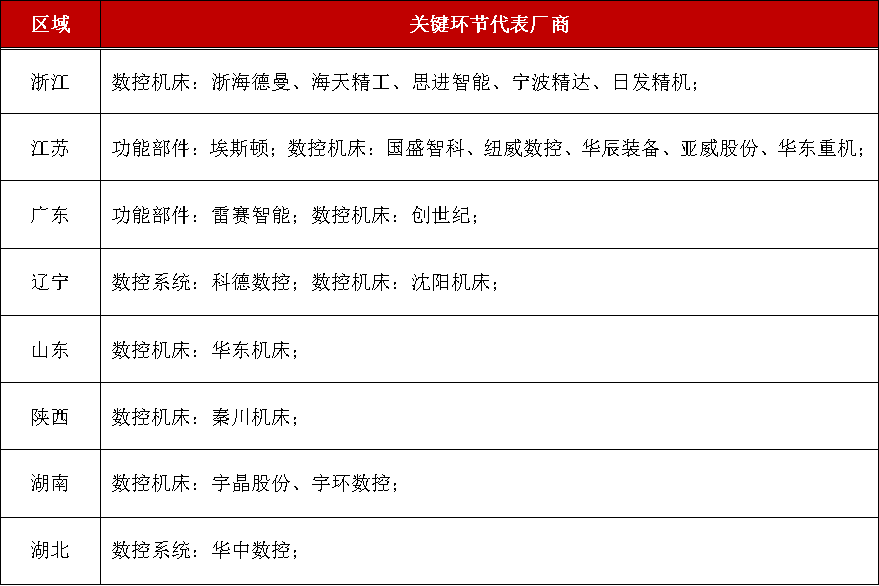

The main competitors in China’s CNC machine tool industry are Genesis, Huazhong CNC, Huading Industrial, Qinchuan Machine Tool, Zhejiang Heidemann, Haitian Precision, Rifa Precision Machinery, Yawei Co., Ltd., East China CNC, Shandong Weida, Kede CNC and Shenyang Machine Tool, Qi Zhong CNC, etc. From the perspective of enterprise distribution, domestic CNC machine tool enterprises mainly exhibit a spatial pattern of “small agglomeration and large dispersion”, and are basically concentrated in the four major agglomeration areas of the China River Delta. Pearls, from the Yangtze River Delta, Bohai Rim and central and western regions.

Among them, Jiangsu, Shandong, Zhejiang, Guangdong and Hebei have many related CNC machine tool companies:

Overall, the competitive landscape of the CNC machine tool industry shows clear tiered divisions. The first tier is multinational corporations and foreign-invested enterprises, which occupy a dominant position in the high-end market due to their brand, technology and other advantages. The second tier includes public or private companies that have independent research and development capabilities and master basic technologies. The third tier is made up of companies that focus on the low-end product market. In recent years, domestic private enterprises have gradually become the main force, and each machine tool factory focuses on its own products, forming a highly fragmented competitive landscape.

03

Bottlenecks in the development of CNC machine tool industry

From a technical point of view, China’s machine tool industry has a weak foundation in the field of high-end CNC machine tools and lacks independent core technologies, which has become a “stuck neck” problem. which seriously restricts my country’s progress towards a “manufacturing power”. “.Specifically, the self-sufficiency rate of high-end materials and parts in the field of CNC machine tools is insufficient. High-end chips, high-quality castings and forgings, high-performance motors, high-quality bearings and high quality Final manufacturing materials mainly depend on foreign imports.

From a market perspective, China’s CNC machine tool industry lacks high-level talents, has weak R&D capabilities, limited production capacity and low market share. The development is mainly focused on expanding the production capacity of mid-range and low-end products. Insufficient investment in the research and development of high-end CNC machine tools, coupled with the foreign blockade of mechanical manufacturing technology, has led to a large gap between the two. the performance and quality of CNC machine tools domestic and foreign countries. Among different CNC machine tool brands, user attention to CNC machine tool brands such as Germany, the United States, Japan, South Korea and Taiwan accounted for more than 60% of the total market.

On the demand side, due to the adjustment and improvement of the overall demand structure of the CNC machine tool industry and the slowdown of the downstream sector, the capacity of China’s machine tool market has declined sharply, making it difficult for machine tool enterprises to accumulate sufficient experience. , data and funds for technology research and development and product upgrading. As a result, the reliability and stability of domestic CNC machine tools are insufficient, and the integration technology is also lacking to integrate process systems and logistics systems. in flexible manufacturing units or flow production lines.

From the perspective of concentration, the downstream of the machine tool industry is parts processing companies, and the needs of these companies vary greatly. Some deal with screws and nuts, and others deal with hammers and shovels. Even products that need to be processed by the same type of machine tools are completely different. The processing requirements are different, and the requirements for customizing machine tools before leaving the factory are also very different. The entire machine tool industry is relatively fragmented and. there is no unified industrial model.

04

Latest Industry Related Policies

The machine tool industry has always been an important strategic point for the country and major enterprises. Especially in the research and development of high-end equipment manufacturing such as automobile manufacturing, railway transportation, aerospace and aerospace satellite, the machine tool industry is. an important strategic pivot for the future competitive force plays an important role. “Made in China 2025” clearly puts forward nine tasks, ten key areas and five projects to vigorously promote the construction of manufacturing power. Among them, intelligent CNC machine tools are considered one of the ten key strategic areas.

In August 2024, the Ministry of Industry and Information Technology, the Ministry of Finance and the State Administration of Taxation issued the “Opinion on Issues Concerning the Formulation of the List of Machinery Enterprises industrial companies benefiting from the value added tax super credit policy in 2024”. “, comprehensively considering the key areas of the industrial machinery industrial chain. Regarding the situation of enterprises, the Ministry of Industry and Information Technology, the Ministry of Finance and the State Administration Tax will conduct a joint review and confirm the final list of businesses for additional VAT credits.

In July 2024, the General Directorate of the Ministry of Industry and Information Technology released the “Industrial Machine +” Docking Activities Implementation Plan at the request of the industry for hundreds of ‘industries and thousands of enterprises’, proposing to promote the promotion, application and iterative upgrade of innovative industrial machinery products and improvement of the industrial machinery industrial chain supply chain Resilience and competitiveness. “Offline” promotes the “1+3+N” series of activities to connect production and demand. Create an “online” information database for industrial mother machine production and demand docking to strengthen information sharing and exchange.

In April 2024, the “Implementation Plan for Promoting Equipment Updating in the Industrial Field” jointly issued by the Ministry of Industry and Information Technology and seven other departments proposed that By 2027, the scale of investments in equipment in the industrial sector will increase by more than 25% compared to 2023; the penetration rate of digital R&D and design tools for industrial companies larger than that indicated. The digital control rate of key processes exceeds 90% and 75% respectively; elimination of backward and inefficient equipment, obsolete equipment; was accelerated and the application of updates to smart manufacturing equipment was encouraged. Focusing on promoting the industrial base machinery industry to update machine tools in use for more than 10 years is expected to catalyze the process of high-end machine tools.

In September 2023, the National Development and Reform Commission, the Ministry of Industry and Information Technology, the Ministry of Finance and the State Administration of Taxation issued the “Announcement of the Four Departments on the increase in the super deduction rate for R&D expenses for integrated circuits. and Industrial Base Machine Enterprises”, which will deduct the R&D expenses of industrial base machine enterprises before tax. and the depreciation rate increased by 20 percentage points.

In September 2023, the Ministry of Industry and Information Technology, the Ministry of Finance and the State Administration of Taxation issued the “Opinion of the Three Departments on Issues Concerning the Designation of the List of industrial machinery companies benefiting from the additional added value.” Tax credit policy in 2023”, proposing to regulate the production and sales of advanced industries. Enterprises that produce main machines, key functional components and numerical control systems are allowed to deduct an additional 15% of the tax input deductible for the current period from the value added tax owed by the company.

In August 2023, seven departments including the Ministry of Industry and Information Technology and the Ministry of Finance launched the “Work Plan for Stable Growth of the Machinery Industry (2023-2023)” , proposing to promote the development of industrial machines, instrumentation, and agriculture. Machinery and equipment and other industries, and improve the standard system.

In February 2023, the State-owned Assets Supervision and Administration Commission proposed to increase investment in science and technology in key areas such as integrated circuits and industrial motherboards, and clearly proposed to increase investments in key areas such as traditional and strategic manufacturing transformation. emerging industries, including integrated circuits and industrial motherboards. Achieve new breakthroughs in key core technologies that are “stuck.”

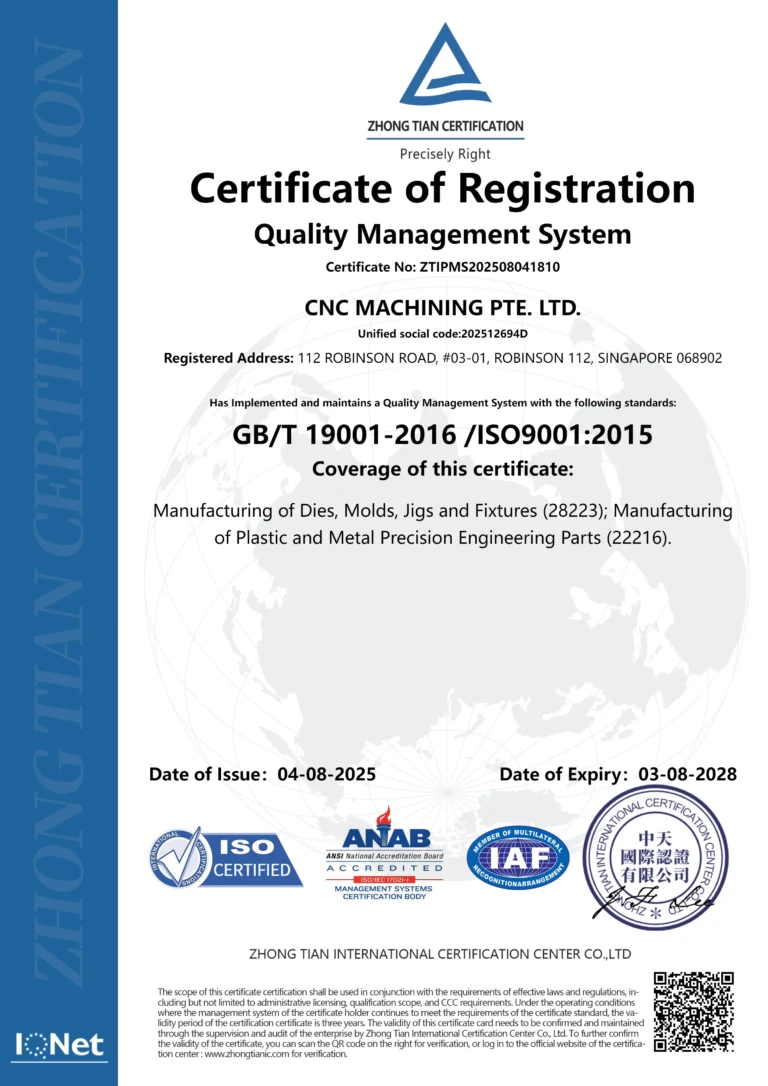

Daguang focuses on providing solutions such as precision CNC machining services (3-axis, 4-axis, 5-axis machining), CNC milling, 3D printing and rapid prototyping services.