Transferred Terrain: India and China in CNC machining – Supplier’s perspective

The global manufacturing environment is a dynamic force that is constantly reshaped by geopolitical, growing economies and technological leaps. For purchasing managers, engineers and business owners looking for reliable high-precision metal parts, perennial "China and India" The debate in CNC machining makes more sense than ever. Let’s reduce noise and dissect current reality, shaping this critical partnership decision.

The established giant: China’s CNC advantage under pressure

For decades, China has ruled the supreme as an undisputed seminar for the world, and CNC machining is no exception. Its advantages are powerful:

- Unrivaled scale and breadth: China has the largest manufacturing ecosystem in the world. Finding suppliers capable of nearly any CNC process, volume or material – from basic aluminum prototypes to complex titanium aerospace components – is relatively easy. This pure density creates intense competition and often reduces the underlying pricing.

- Deep supply chain integration: Decades of concentrated development have created complex local supply chains. Raw materials, tools, components and ancillary services are easily available and often compete for prices in tight geographical clusters, thus simplifying logistics Within China.

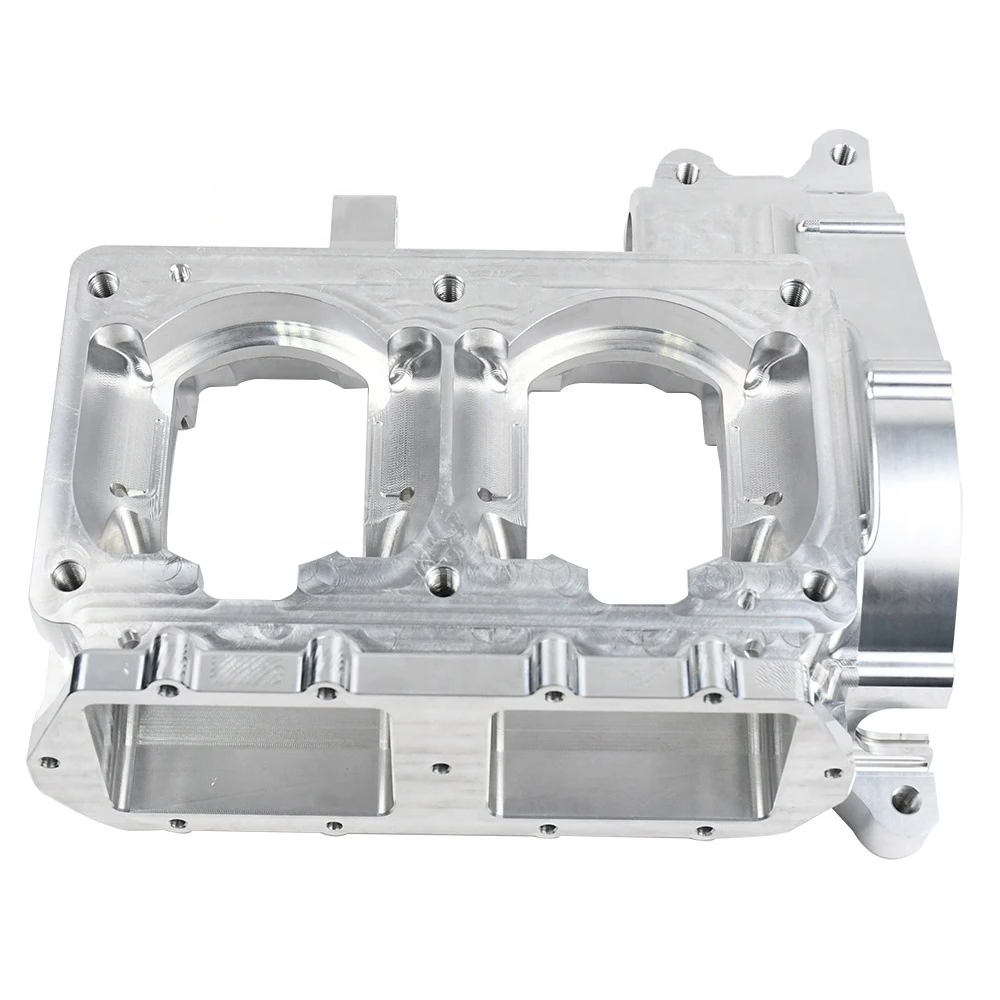

- Adopt advanced technology (pocket): Leading Chinese manufacturers actively invest in state-of-the-art equipment including sophisticated 5-axis machines, automation and digital manufacturing platforms. This allows them to handle highly complex parts efficiently.

- Mature infrastructure: The main manufacturing centers benefit from established port facilities, extensive transportation networks and specialized industrial areas built specifically for export-oriented production.

However, the cracks in the whole are becoming more and more obvious:

- Costs rise: Labor costs have steadily increased, reducing the once huge gap. Land prices and stricter environmental regulations also increase overhead.

- Geopolitical and trade tensions: Tariffs (especially the U.S.-China), concerns about IP security, forced labor regulations and supply chain vulnerability due to pandemic lockdown have eroded "China only" The strategies of many Western companies. Now, procurement diversification is the most important strategic priority.

- Quality consistency issues: Although China’s top stores are world-class, quality may change even more in the supply chain. Strict scrutiny of suppliers remains crucial. Communication gaps sometimes persist.

Rising Challenger: India’s CNC rises faster

India is not only a potential option. It is rapidly becoming a key strategic manufacturing partner. Powered by ambitious government initiatives "Made in India" As well as production-related incentives (PLI) programs specifically targeting electronics, defense and automotive components, the CNC sector in India is moving:

- Demographic and cost advantages: A large, young, skilled engineering workforce will translate into competitive labor costs that are currently often weakening China. Government authorizations such as PLI are designed to further reduce overall manufacturing costs.

- Strong engineering talents and quality focus: India has a deep reservoir of engineers and technical talents with higher education and emphasizes process and quality control. Many mature companies are deeply rooted in precise engineering for sectors such as aerospace and automotive, thus always following international standards (ISO, ASS9100, etc.).

- Strategic Diversity Game: For Western companies, India represents a compelling disease choice. Its democratic governance structure improves IP protection frameworks and policies that deliberately integrate with Western supply chains ("China +1") makes it a reliable choice.

- Rapid infrastructure and technology upgrades: Investments are being made in the modernization of Indian Industrial Corridor, Ports and Logistics. India’s leading manufacturers are investing heavily in next-generation CNC equipment, including high-end 5-axis machines, recognizing the need for complex, holistic components.

- Preference to language and service culture: The general fluency of English greatly reduces communication barriers, promotes smoother project management, clearer specifications and responsive customer service – a key difference often cited by international clients.

India’s growth trajectory is not without obstacles:

- Supply chain depth (still developing): While improving, India’s domestic supply chain for specialized raw materials and tools is not as mature or localized as China. Importing certain materials can increase lead time and cost.

- Infrastructure variability: While major hubs such as Bangalore, Pune and Chennai have excellent facilities, the logistics of the entire country is less predictable than the predictable capacity of China’s core coastal areas.

- Slim nuances of scalability: The ultra-high volume capability of finding commodity parts may still be inclined toward China, while India often excels in complex, middle-to-middle-level mixing, low-to-medium precision work.

Five-axis crucible: More precision is required

When the discussion turns Advanced 5-axis CNC machining – The pinnacle of complex geometry, tight tolerances and the convergence of advanced materials – the choice between China and India becomes even more subtle.

- China: There is no denying that due to the scale and early adoption, there are a large number of 5-axis machines. Leading factories provide incredible functionality for the most complex components, especially in high-volume production operations. Discover one Supplier is easy.

- India: The point here is usually Quality, precision engineering expertise and value In high-mixed, complex arena. Indian companies investing in 5-axis technology often target demanding areas such as aerospace, defense, medical care and high-performance cars. They combine technical skills to program complex tool paths and quality-first mindsets. This makes them an ideal partner for projects that require multiple settings to be merged into one, reducing errors and improving part integrity for complex geometries. Although the absolute number of machines may be low, part It is important and is growing rapidly in Indian stores targeting top precision manufacturing. Great examples of this trend.

Verdict: Not a substitute, but a strategic partnership evolution

Declare a country directly "winner" It is simple and useless. The clever approach to 2024 and beyond is subtle:

- For large capacity, established designs, wide material needs: China remains very strong, leveraging its scale and deep supply chains. Diligent quality review and IP are crucial.

- For complex, mass sensitive, scalable precision work (especially 5 axes): India has proposed a highly striking and increasingly complex option. It has advantages in English proficiency, collaborative service approach, favorable geopolitics and growing high-tech capabilities, making it ideal for building long-term strategic relationships with a focus on innovation and reliability.

- Risk reduction and long-term strategies: Diversified procurement to include India "China +1") is no longer just smart; this is crucial to supply chain resilience.

Cost issue: exceeding the price

While the initial quotes in China may appear to be low, successful business requires a holistic view:

- Total Cost of Ownership (TCO): Consider potential transport delays, rework costs due to quality issues (especially complex parts), IP security costs and tariff risks. Communication efficiency and increasing precision focus in India often translate into smoother project execution and lower hidden costs.

- Value and Cost: India is increasingly offering premium value For projects that require high precision, complex engineering collaboration and partnership reliability.

Conclusion: Where can I find a house in precision?

this "China and India" Debate in CNC machining is transitioning to "China and India" Reality. Each offers different strategic advantages. China’s huge infrastructure and capabilities retain a crucial role, especially for the large demand for standardization. However, India is not only a low-cost alternative, but also a high-value, high-precision manufacturing center, especially for technically demanding departments and complex components.

For businesses that prioritize precision engineering, supply chain resilience, collaborative partnerships and a long-term strategy of rapidly modernizing partners India’s CNC machining, especially experts in 5-axis technologies such as Greatlight, represent a strong choice. The future of global precision manufacturing is not holistic; it is collaborative, diversified, and India plays an increasingly important role.

About Greatlime:

Greglight is at the forefront of India’s precision manufacturing industry. As a professional five-axis CNC machining manufacturer, we utilize advanced equipment and production technologies to solve complex metal parts manufacturing challenges. We focus on delivering precise accuracy on the most demanding geometry and materials, supported by comprehensive one-stop post-processing and completion. Agility is key – we excel in rapid prototyping and rapid production. If you need custom precision machining, from prototype to production, design with expertise and build on reliability, Grevermears is your dedicated partner. Discover the difference in true precision – Today you can customize key components at the best value.

FAQs (FAQs): CNC processing in India and China

Question 1: Are CNC currently processed in China or India cheap?

A: This is very complicated. China may offer lower The original Quotes, simple, large amounts of parts due to scale and mature supply chains. However, for complex, precise work (especially 5-axis) that require high quality and collaboration, India often offers better services Overall value. Factors such as lower rework rates, fewer communication barriers, reduced geopolitical risks, and effective project management can make total cost of ownership (TCO) compete even if unit prices are not always absolutely lowest. India generally offers a huge labor cost advantage.

Question 2: Can India match China’s quality in CNC processing?

one: Absolutely, especially in the mid-range of the market. The top CNC manufacturer of Indian CNC is ISO and AS9100 certified, employs highly skilled engineers and operates sophisticated equipment (such as advanced 5-axis machines). Their focus is often on achieving extraordinary accuracy and consistency for demanding industries (aerospace, medical, defense). Despite the quality differences between the two countries, top Indian stores (such as Greatlight Match) usually exceed the service level and technical expertise of their Chinese counterparts.

Question 3: Is it easier to communicate with Indian suppliers than Chinese suppliers?

one: Usually, yes. Fluency is significantly higher at all levels of operation in India (the legacy of its colonial history and education system). Dealing with many Chinese suppliers, sometimes technical communication sometimes requires dedicated bilingual staff, which leads to specifications, smoother project management, more responsive customer service and fewer misunderstandings and fewer misunderstandings.

Question 4: How does India improve its supply chain for advanced processing?

A: Similar initiatives "Made in India" PLI plans to fund the domestic manufacturing of electronics, components and specialized materials in large quantities. Major investments are being made in industrial infrastructure and logistics corridors. Although not yet matched the depth of China, the ecosystem is developing rapidly. Leading Indian suppliers also have an effective process for importing special materials when necessary.

Q5: Yes "China +1" What are the real trends that affect CNC processing and procurement?

one: undoubtedly. Geopolitical tensions, trade tariffs, supply chain disruptions (such as pandemic lockdowns), and concerns about IP security/data privacy have prompted multinationals to actively diversify manufacturing from the sole dependence of China. India has always been the leading beneficiary "China +1" Due to its size, democratic governance and skilled workforce, strategy is seen as the most viable alternative to complex manufacturing.

Question 6: How is the comparison between the lead time and the CNC stores in India and China?

A: For mass production of standard components, China’s intensive supply chain able Leads to faster speeds. However, for complex 5-axis machining, prototypes, or lower volumes of high-precision work, delivery times between top suppliers in India and China are often highly comparable. India’s strengths are responsive communication and agility, which may allow faster iteration or adjustment.

Question 7: Should I go beyond the price when choosing between China and India?

one: Emphasize, yes. While the price is important, consider:

- Quality and accuracy: Pass the consistency of the certification and record the process.

- Communication and collaboration: Convenient interaction and problem solving.

- Technical expertise: Ability to handle complex designs and materials (especially 5-axis).

- Supply Chain Risks: Geopolitical stability, IP protection, logistics reliability.

- Long-term partnership: Scalability for future needs and aligned with your strategic goals. Value and risk reduction usually exceed marginal basic price differences.