As 2025 approaches, it is time to take stock of the past year as we usually do. At this time last year, we were already discussing certain trends with you, such as the industrial slowdown or the development of artificial intelligence. These 2023 trends have implications for 2024, which might be the first thing we take a closer look at before diving into our review of the year.

Last year, we kicked off our review by discussing artificial intelligence and its growing impact on the industry.Artificial intelligence software will continue to gain a foothold in additive manufacturing in 2023, although enthusiasm for its potential has waned somewhat. This does not mean that AI is a disappointment, on the contrary: it is gradually consolidating its presence in targeted applications such as the medical field, while remaining a pillar of generative design. This quieter but equally important role illustrates how AI continues to evolve and meet specific user needs. Just like 3D printing, artificial intelligence will not change every area, but it will prevail where it can truly make a difference.

The Bambu Lab A1 was recalled this year, but the company still saw strong growth (Photo credit: Bambu Lab).

Budget remains a key factor in the industry.In 2023, Bambu Lab rose to prominence by attracting attention with its fast and affordable desktop solutions. This dynamic continues until 2024. Despite some challenges, notably the recall of its A1 3D printer, Bambu Lab has continued to establish itself as a major player in the sector, rapidly expanding its product range. This development highlights an important reality: affordability remains a key priority for many 3D printing users.

butWhat are the other trends in 3D printing in 2024? What will have the biggest impact on the industry this year? Let’s take a closer look.

The additive manufacturing market is getting darker

There is no doubt:In 2024, the 3D printing industry will continue to face major challenges. This is not only due to the global economic slowdown, but also because this technology has been particularly hard hit. Much of this comes from the bursting of the bubble in 2023, which resulted in growth hurdles that continue to weigh heavily on the market.

For example, in our dedicated discussionIn our article on 3D printing trends in 2023, we discussed the instability of the sector, illustrated by the large number of mergers and layoff announcements. These phenomena also mark the arrival of 2024 and confirm the persistence of these structural challenges.

In September 2024, Stratasys announced a layoff plan affecting approximately 15% of its employees. At the same time, another major player, 3D Systems, has chosen to sell its metrology software to refocus its efforts on a portfolio of solutions dedicated to 3D printing. The year was also marked by the bankruptcy of Shapeways, despite the possibility of its revival. In fact, the company acquired the popular Thangs template platform before declaring bankruptcy. For its part, Markforged is facing increasing difficulties after being ordered to pay $17 million to Continuation Composites in the context of an intellectual property dispute. This situation is aggravated by previous leaders’ criticism of current management skills. In this context, Nano Dimension announced its intention to acquire Markforged, adding a new dimension to this turbulent period for the company.

Actually,Nano Dimension has made a splash in terms of acquisitions this year. In addition to Markforged, the company also announced plans to acquire Desktop Metal, which has been struggling for several years. Although the issue appears to have been resolved, Nano Dimension CEO Yoav Stern has raised questions. Meanwhile, activist shareholder Murchinson Ltd’s stake stands at around 7.1%, part of a long-running battle led by its nominee director candidates Ofir Baharav and Robert Pons in the leadership battle of the company. Elected to the board of directors.

With the resignation of six directors, theUncertainty has further mounted for Nano Dimension, which has seen its board reduced to four members supported by Murchinson. Despite this instability, the new board said: “As a newly reconstituted board, we are committed to ensuring strong corporate governance and implementing strategies that maximize long-term shareholder value. . » This statement, while optimistic, demonstrates commitment to Nano. choice that the Dimension board of directors has made so far.

Of course, the saga has been going on for a long time, as Murchinson has been trying to replace the incompetent Yoav for some time.· Yoav Stern. “Nano’s board of directors has demonstrated that it is unable or unwilling to hold management accountable and lacks the judgment necessary to use Nano’s cash and other resources responsibly,” said the company in a press release.

Where does this leave us? Clearly, the market is not ready to stabilize.What’s going on with Markforged and Desktop Metal? It seems unlikely that the acquisition will be completed, but it is not yet certain. However, the fact that only Murchinson remains on Nano Dimension’s board makes rejection of these deals more likely.

Regardless, despite a more conservative year focused on stability rather than growth, some positive signs are emerging.The atmosphere at Formnext was livelier than in 2023, with press releases abounding and partnerships within the industry particularly highlighted. This collaboration is a reliable way to help strengthen the additive manufacturing industry during this difficult time.

3D printing applications will be the focus in 2024

This year we noticed that there was more focus on real-world applications rather than machine innovation. This is a sign that the market is responding to the loss of confidence in over-promises by clearly showing how the technology can be used.

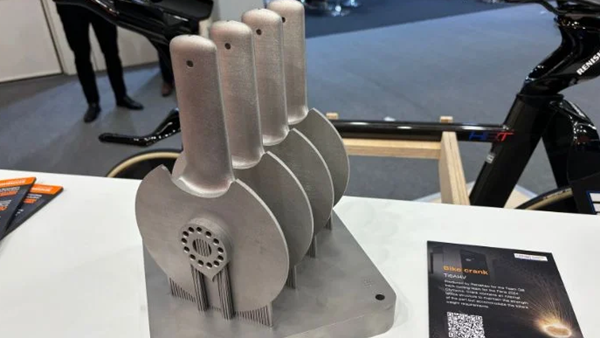

Renishaw inThe Formnext 2024 booth front showcases 3D printing applications, including applications for bicycles (Photo credit: 3Dnatives).

For example, at a trade show, while machines are clearly present, more space is devoted to physical applications. Take Renishaw for example. The British manufacturer is exhibiting numerous creations, including a bicycle used at the Paris Olympics and itsA 3D printed part, this is one of the most interesting metal parts we’ve seen this year.

The press releases issued during the year also bear witness to this. Whether in the medical, aerospace, construction or automotive sectors, the main manufacturers are demonstrating interesting applications. This situation stands in stark contrast to just a few years ago, where while apps certainly existed, we saw far more innovation than they could handle. This is a direct response to criticism leveled against the additive manufacturing market, namely3D printing does not keep its promises.

As mentioned earlier, one of the factors particularly affecting the additive manufacturing market is users’ frustration with the performance of the machines, despite the general slowdown in the technology. Although3D printers offer exciting possibilities and have many uses, but it’s important to maintain realistic expectations of what they can actually do.

by descriptionPractical uses of 3D printing, highlighting specific applications, directly address this problem. Another way to do this is a growing trend: prototyping and tooling are returning as core applications alongside hybrid manufacturing. The industry appears to have recognized the importance of guiding users by showing them clear use cases and helping them choose the right technology for their needs.

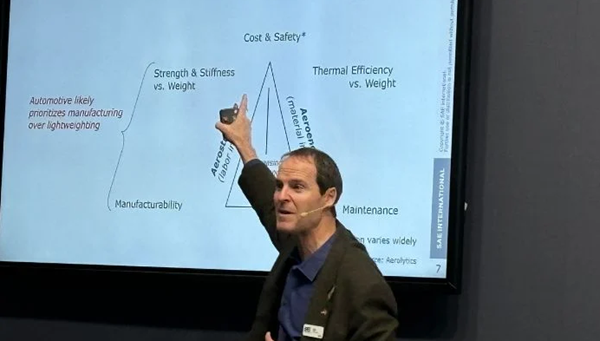

This has also led to an increase in certifications in the industry. For a long time,3D printing has long been seen as a barrier to adoption, but one of the most notable developments in 3D printing at Formnext 2024 is the focus on part and process certification. Leading organizations, including those working in specific industries such as SAE in aerospace and general manufacturing, are making advancements that make 3D printing parts easier for users. Obviously, this dynamic will continue until 2025, helping to revitalize the additive manufacturing market.

3D printing trends in 2024

The presence of SAE International at Formnext 2024, notably in a presentation on the design of 3D printed parts for the automotive and aerospace industry, demonstrated the importance of certification in the industry in 2024 (Photo credit: 3Dnatives).

China has been a major player in additive manufacturing for many years. Over the past year, however, we have seen a real strengthening of the presence of Chinese manufacturers, particularly in the field of industrial additive manufacturing. This expansion in China isOne of the main trends in 3D printing in 2024.

One of the manifestations of Chinese growth can be observed inSeen on Formnext. In previous exhibitions, although Chinese companies participated, they were mainly large companies or professional companies in the industry. For example, companies such as Creality and Farsoon High-Tech regularly participate. But this year we saw a real expansion, with around a hundred Chinese exhibitors, some even occupying the largest stands at the show.

While many Western exhibitors opted for smaller booths, some of the most impressive booths came from Chinese manufacturers. For example,Eplus3D has a two-story booth focused on industrial applications of metal additive manufacturing, such as rocket nozzles. Bambu Lab and Creality are next to each other and occupy a relatively spacious booth than other exhibitors, attracting a large number of people.

ChinaThe growth of 3D printing is also reflected in other indicators. For example, a report from Grand View Research shows that after generating 1.45 billion euros in 2023, China’s 3D printing market is expected to reach 7.907 billion euros by 2030, with a growth rate Compound Annual Compound (CAGR) of 27.5% from 2024 to 2024. In comparison, by 2030, the global 3D printing market is expected to grow at a compound annual growth rate of 23.5% over the same period, while North America, the current largest market, only will only experience growth of 22.4%.

according toAccording to the CONTEXT report released in January 2024, China’s entry-level 3D printing market is one of the most profitable markets in the world. Bambu Lab in FDM and ELEGOO in resin printing stand out particularly for their strong growth despite a general drop in revenues. The report also highlights that these entry-level printers are starting to make inroads into the industrial 3D printing market, as they can be used in professional applications while being priced more competitively.

That said, the country is experiencing significant industrialization. With Chinese office and entry levelAs 3D printers continue to gain popularity, companies such as Bright Laser Technologies (BLT), Eplus3D and Farsoon High-Tech are not only standing out this year with a large number of innovative applications, but are also making huge profits . BLT, in particular, is one of the most profitable additive manufacturing companies in the world, with revenue growing by almost 60% between 2022 and 2023, a performance that will continue until 2024.

Of course, this growth is not without consequences. In addition to intensifying competition with Chinese manufacturers, patent infringement complaints have also been filed.The conflict between Stratasys and Bambu Lab is an obvious example.

This year,Stratasys sued Bambu Lab for patent infringement, accusing it of using patented technology in its 3D printers, including purification towers and heated print beds. The case, still pending, has sparked debate and divided opinions among users and manufacturers of 3D printers.

Who is right? The answer probably lies somewhere in between. Regardless, it can be said with certainty that China’s rise has becomeOne of the main trends in 3D printing in 2024.

Sensationalism on the rise

In such a tumultuous year, we have also seenThe rise of sensation in the field of 3D printing. What do we mean by this? Many hot topics have emerged and sparked discussions, particularly in the mainstream media.

For example, many media often mention3D printed weapons. Despite the hard facts, cases involving 3D printed weapons have emerged in recent years, and it is reasonable for governments to be interested in them, but this does not reflect the complete picture. 3D printed weapons remain a marginal issue in most countries, but they receive disproportionate attention.

3D printed meat, like this example from Steakholder Foods, has been a widely debated topic in 2024 (Photo credit: Steakholder Foods).

That said, sensationalism should not be viewed solely in a negative light. While we see an increase in rumors and sensational articles in the industry, there is also a form of sensationalism used to promote additive manufacturing. in the food and construction sectorsThis is especially true with 3D printing.

Finally, in the construction sector, the industry has demonstrated the effectiveness of additive manufacturing, having already built several houses using this technology. arriveIn 2024, there are also many examples of how 3D printing in the construction sector can help increase property prices and directly address the global housing crisis.

The restaurant sector is also booming.Companies like Revo Foods and Steakholder Foods are able to produce 3D printed meat and fish, known to be more environmentally friendly. This has sparked debate, particularly when some of these products appear in supermarkets. However, the industry is also characterized by sensationalism, particularly from non-3D printing media, over whether 3D printed meat should be consumed.

This sensationalism is intentional. he will do it when necessary3D printing has been brought to the forefront, especially for those who are not yet familiar with these technologies.

At any rate,2024 will be a pivotal year for the 3D printing industry. It will be interesting to see if the industry continues on this trajectory, or if 2025 marks a turning point.

Daguang focuses on providing solutions such as precision CNC machining services (3-axis, 4-axis, 5-axis machining), CNC milling, 3D printing and rapid prototyping services.