according toAccording to the latest market research from VoxelMatters, the aerospace industry purchased more than $1.5 billion worth of 3D printers, printing materials, hardware, parts and related services in 2023. Details of Their use of this technology for 3D printing has rarely been revealed, but according to VoxelMatters, the aerospace industry is adopting metal and polymer 3D printing at record levels.

In fact, the market is expected to grow over the next decade forA $20.5 billion business opportunity with a compound annual growth rate (CAGR) of 29%.

Davide Sher, co-founder and CEO of VoxelMatters, said: “The aerospace industry is one of the largest users of additive manufacturing (AM) technology, partly due (but not exclusively) to the demand growing for defense applications. Being one of the most mature application areas of additive manufacturing, its applications include prototypes, tools and, increasingly, final parts, thereby generating revenue and industry revenue growth.

picture1:GE Aerospace’s GE9X engine contains seven 3D printed parts (Source: GE Aerospace)

This New Market Research Provides Insight into Aerospace Parts Manufacturing3D printing engineering metals, polymers, and ceramics are analyzed and forecasted, focusing on the hardware, materials, and services segments of the additive manufacturing market. Researchers studied AM part production data from end-user companies in the aerospace industry, including Airbus, Boeing, Lufthansa Technik, Rolls-Royce, SpaceX, Northrop Grumman and Ursa Major, as well as 3D data from printer manufacturers, services and materials suppliers.

An example of 3D printing in the aerospace sector is the 3D printed fuel nozzle for the GE Aerospace CFM LEAP engine, produced jointly by GE and its long-time partner Snecma of France. GE has just announced that global aviation finance company Avolon has ordered 150 LEAP-1A engines to power 75 A320 aircraft. GE has also 3D printed parts for its GEnx and GE9X engines, with EVA Air recently committing to power four 787 aircraft and Qatar Airways committing to use 40 GE9X engines for 20,777 aircraft.

Overall, the aerospace additive manufacturing market is dominated byAdopter Drives, a term used by VoxelMatters to describe end users in the aerospace industry, including original equipment manufacturers, first and second tier suppliers, and some aerospace specialty subcontractors. In addition to adopters, the market is made up of AM service providers and suppliers as well as equipment and materials suppliers.

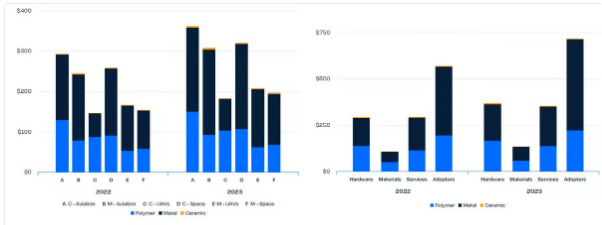

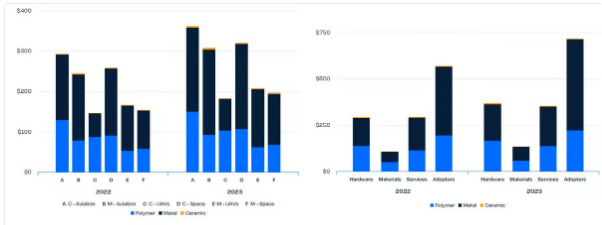

In 2023, adopters will account for 45.5% of total revenue ($718 million), while hardware sales will account for 23.5% of total revenue ($370 million) and services 22 .5% ($355 million). The smallest subsegment, materials sales, contributed 8.5% of revenue to $134 million.

Figure 2: Kratos is an aerospace company best known for its XQ-58A Valkyrie drone, the company’s most capable.I bought one recentlyVelo3D Sapphire metal 3D printer (Source: Kratos)

Civil and military aviation in3D printing applications are almost flat

In 2023, civil aviation (companies like Boeing and Airbus) is the largest contributor to the market with a 22.9% share, while military aviation follows closely with a 20.3% share. The remaining market share is split between civil aerospace companies (19.5%) (like SpaceX), military aerospace companies (13.2%), military drones (12.5%), and civil drones (11. 6%) (like Krato).

Metal3D printing dominates the aerospace 3D printing market. It accounts for 62% of the market’s total revenue, with “adopters” generating half of the metal’s revenue, for an estimated total of $492 million. Sales of metal materials, typically powders, accounted for 7.8% of metals revenue, up 35.9% from 2022 estimates. Metal materials accounted for just over half of all material sales in the aerospace market, reaching $76 million.

picture3:AndTotal aerospace 3D printing revenue will increase sharply in 2023 compared to industry data in 2022 (Source: VoxelMatters)

Likewise, metal3D printers accounted for the largest share of hardware sales in this market, accounting for 53.1% of total hardware revenue, growing 29% to $196 million (accounting for 12.4% of total hardware revenue). entire market). Within the materials segment, metal materials accounted for 56.7% of revenue, growing 35.9% to $76 million (4.8% of the market). Metal AM Services was the leader in the services segment, accounting for 60.2% of total revenue, growing 20.7% to $214 million (13.5% of the market).

“We are impressed by the dominance of metal additive manufacturing products, including hardware, materials and parts, in terms of revenue,” Sher said. “Currently, powders and powder-based processes undoubtedly dominate the market, both in terms of part volume and revenue. »

polymer3D printing has had a significant impact on civilian drones, accounting for 56.5% of polymer revenue. Although technical ceramic AM remains a niche market, it has seen significant growth in civil space applications due to the material’s suitability for extreme environments.

Aerospace additive manufacturing in 2033

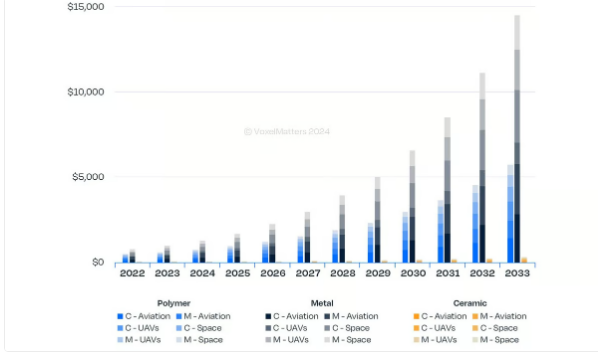

picture4

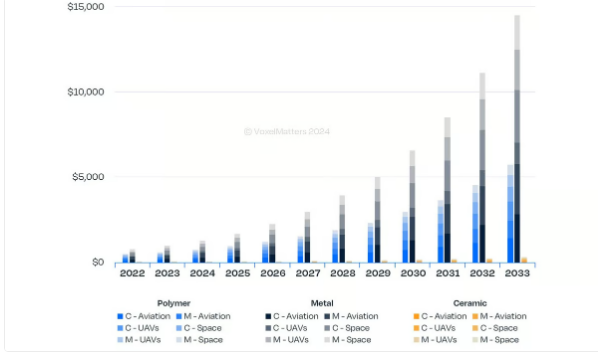

expectedBy 2033, aerospace AM sales will exceed $20 billion, and hardware revenue is expected to reach $3.9 billion.

Adopters are expected to occupy51% market share, while hardware share is expected to decrease to 19%, confirming the maturity of the sector compared to other technology-driven AM segments. The segment is expected to reach $10.5 billion, with metal adopters accounting for 77.5% of the value. Hardware revenue is expected to reach $3.9 billion, including 53.2% for metal hardware, 43.4% for polymers and 3.5% for technical ceramics. Materials revenue is expected to reach $1.7 billion, with metals accounting for 70.3%. Services are expected to contribute US$4.5 billion, mainly from metallurgical services, accounting for 69.8%.

Daguang focuses on providing solutions such as precision CNC machining services (3-axis, 4-axis, 5-axis machining), CNC milling, 3D printing and rapid prototyping services.